HAIL AT A GLANCE – KEY HIGHLIGHTS OF THE REGION

- 2nd largest producer of open-field potatoes and 3rd largest producer of grains, grapes, and olives in the Kingdom (2018)

- 14,763 agriculture holdings – comprising 5.2% of the Kingdom’s total (2017)

- 4th largest sheep breeding and 5th largest poultry farming across the Kingdom (2018)

- Home to 2 UNESCO world heritage sites and unique natural assets

- The number of tourist trips to the region more than doubled in the past 5 years

- SAR 1,087.5 Mn in total tourist expenditure spent in the region in 2020

Across its 8 governates, Hail has diverse ecosystems, world-renowned touristic sites of which 2 belong to the UNESCO world heritage, a unique rally track that hosts international championships, and significant agricultural areas that constitute more than 5% of the Kingdom’s total.

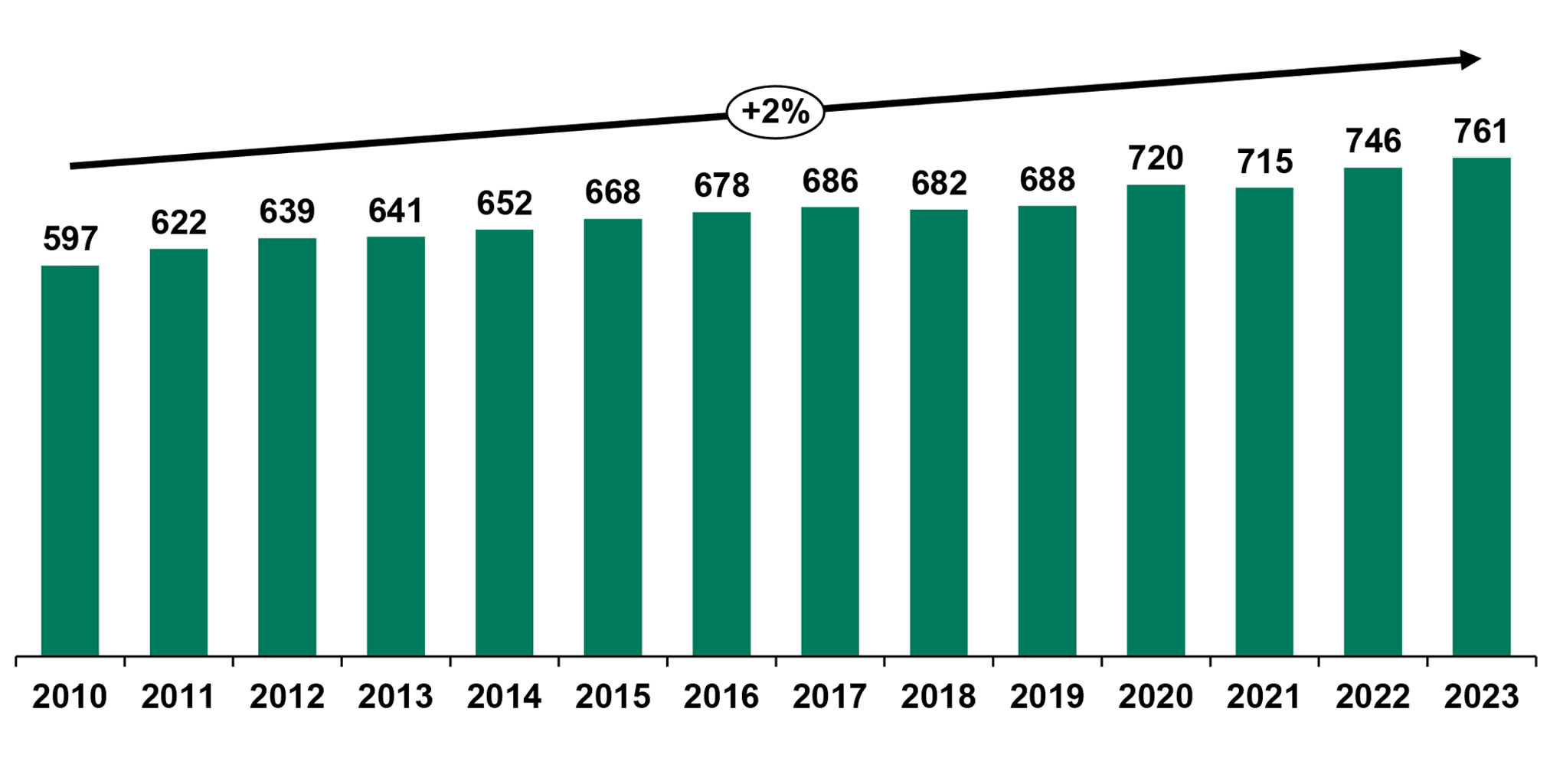

Its population has grown and was expected to reach 761k by 2023, with the majority being under 35 years of age mostly made up of men, mainly of Saudi nationality

Population growth of Hail region, 2010 – 2023

Thousands

- Hail population has been increasing over the past years reaching up to 746k by 2022, growing at a CAGR of 2% and is expected to reach 761k by 2023¹.

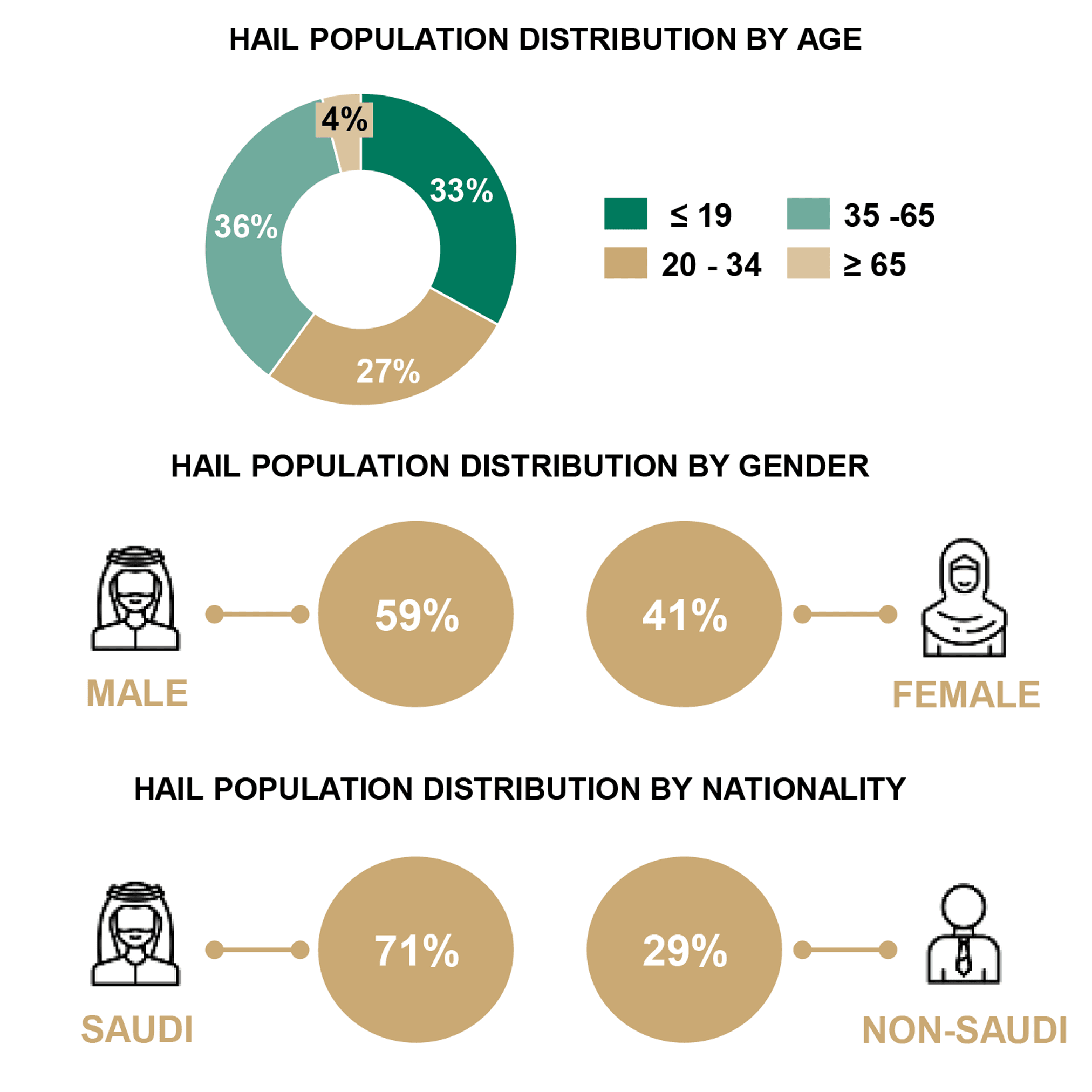

- Hail’s population is considered relatively young with approximately 60% of its population being below the age of 35.

- Its inhabitants comprise a male majority of approximately 59% compared to 41% for female population

- There is a propensity for Saudis (approximately 71% of the population) compared to non-Saudis (approximately 29%)

Hail Demographic Snapshot, 2022

estimated using a growth rate of 2% for the population increase from 2010-2022

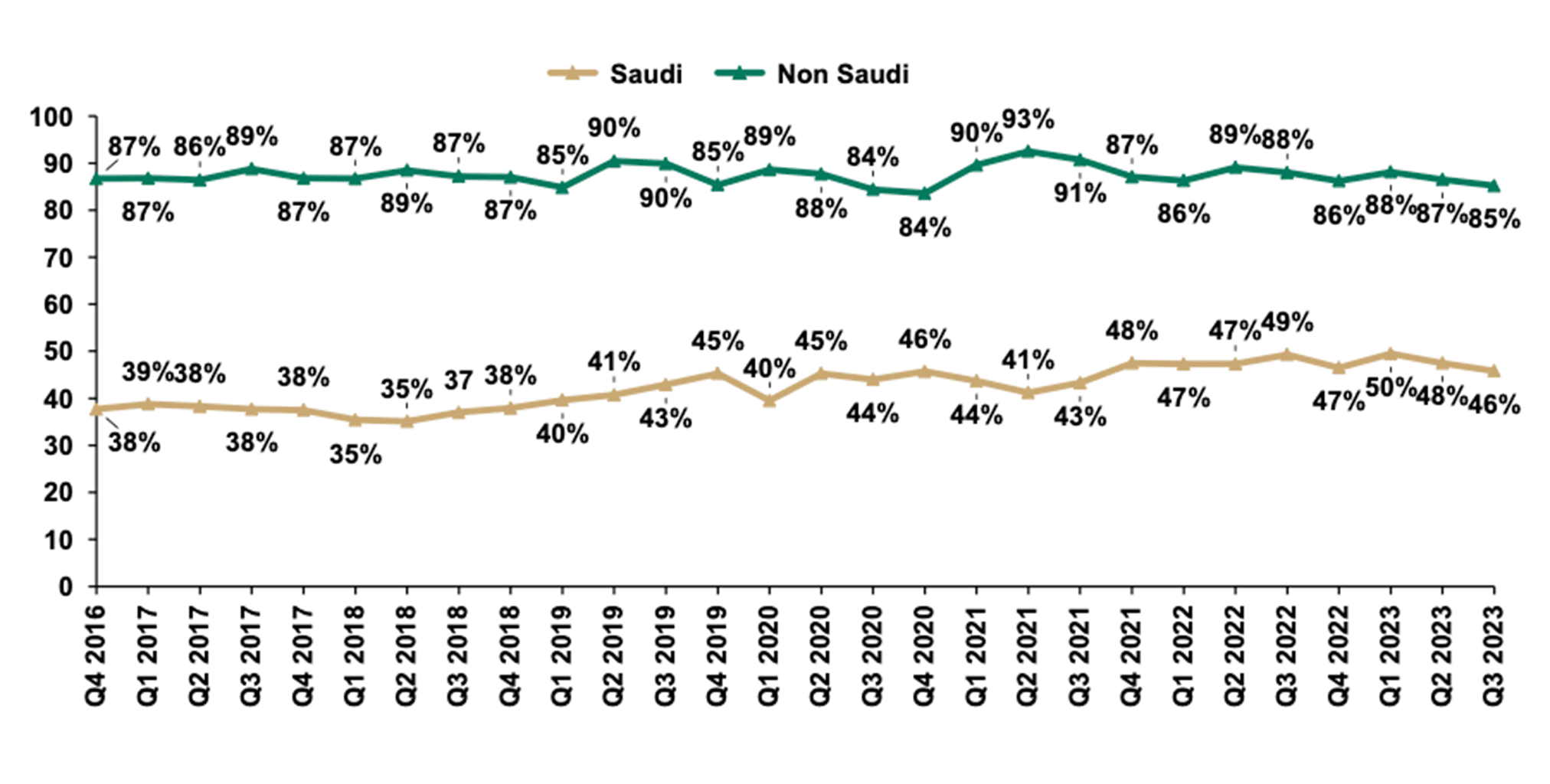

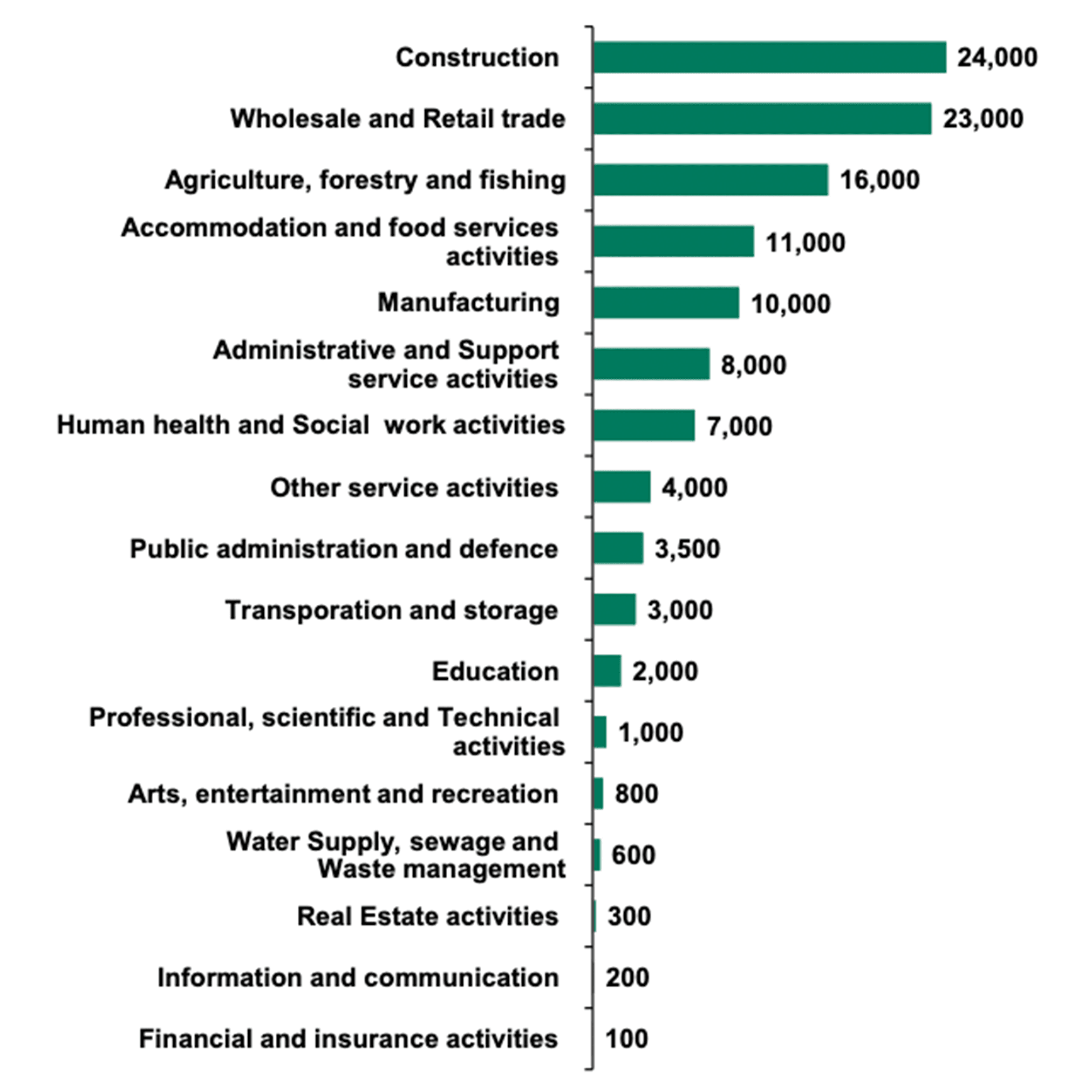

This was translated into an increase in Saudi labor force participation especially in construction, wholesale and retail trade, agriculture, accommodation and food service

Saudi and Non-Saudi Labor Force Participation Rate, Q4 2016 – Q3 2023

%

- Over the past years, with the support of KSA government initiatives and regulations to increase Saudis employment, which led to an increase in Saudi Labor force participation from c.38% by the end of 2016 to c.46% by Q3 of 2023.

- As for Non-Saudis, labor force participation was almost stable between 85-87% from the end of 2016 to Q3 of 2022.

- Construction, Wholesale and retail trade, agriculture, accommodation and food services activities top the economic activities where Hail inhabitants work.

Number of Employees by Economic Activities, Q4 2022

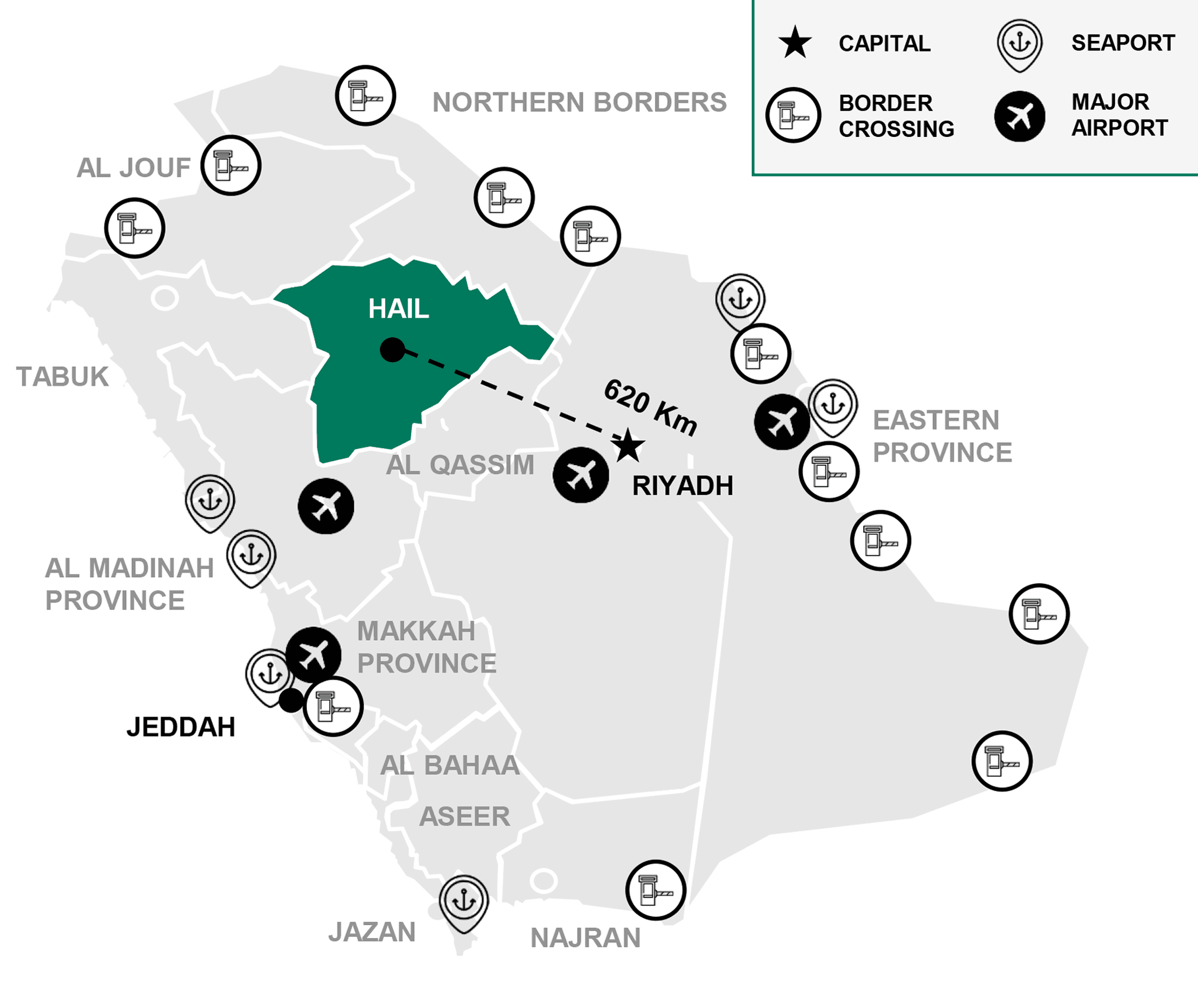

Located at the center of the Kingdom, Hail enjoys a distinct location north of the capital with infrastructure nodes connecting its cities to other regions

Hail Location and Connectivity within KSA

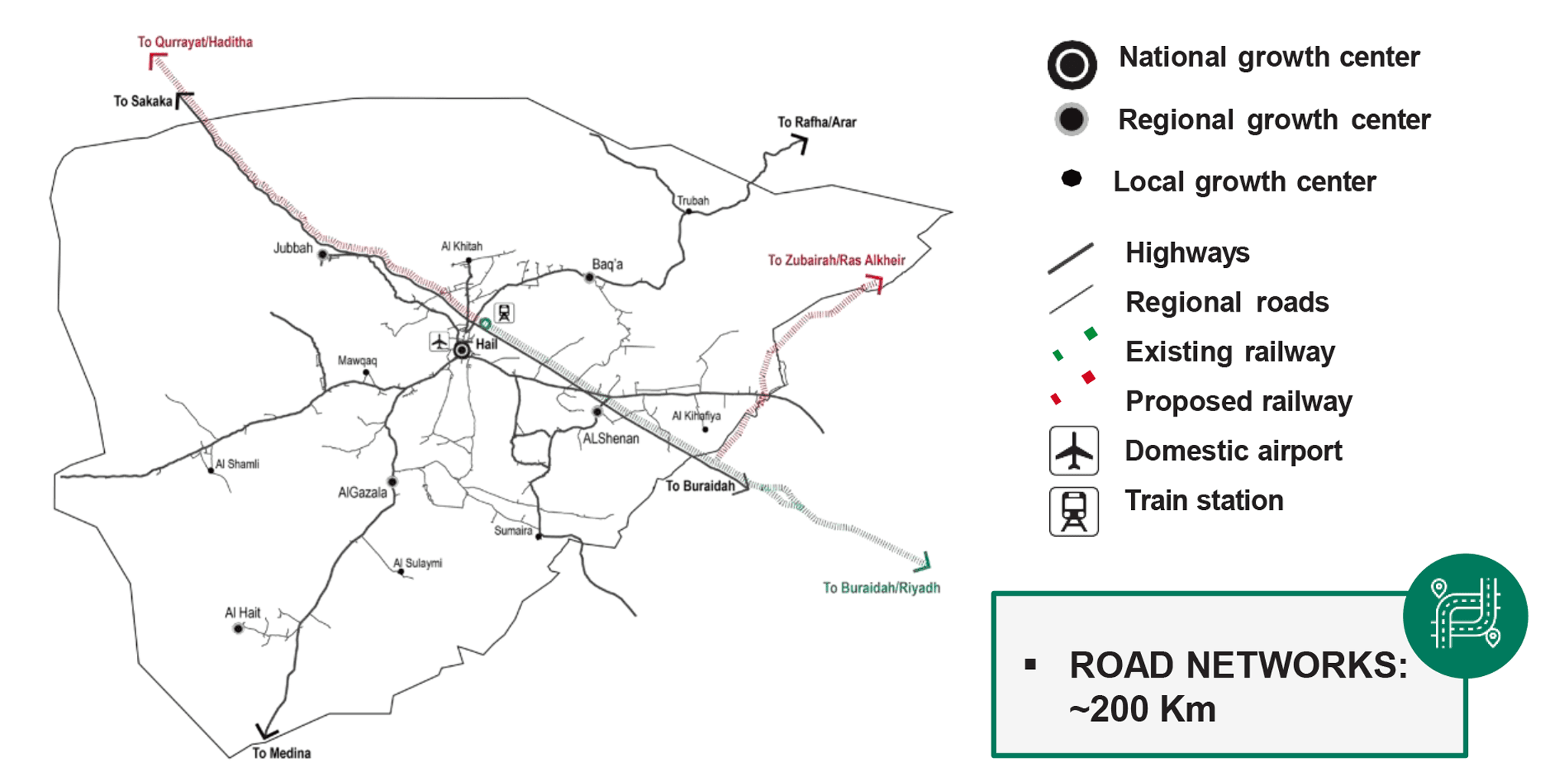

Transport Infrastructure Nodes and Connectivity within Hail Region

- Located at the center of KSA, Hail enjoys a distinct location on a proximity to the East and West of the Kingdom and at distance of approximately 620 Km from the capital, Riyadh.

- It is well connected to major airports, seaports and border crossings in KSA through major transport infrastructures nodes and highways at Kingdom level.

- On Hail region side, the cities are well connected through a road network spanning approximately 200 km. Additionally, the Qurayyat-Buraidah/Riyadh railway line further contributes to the connectivity in the area.

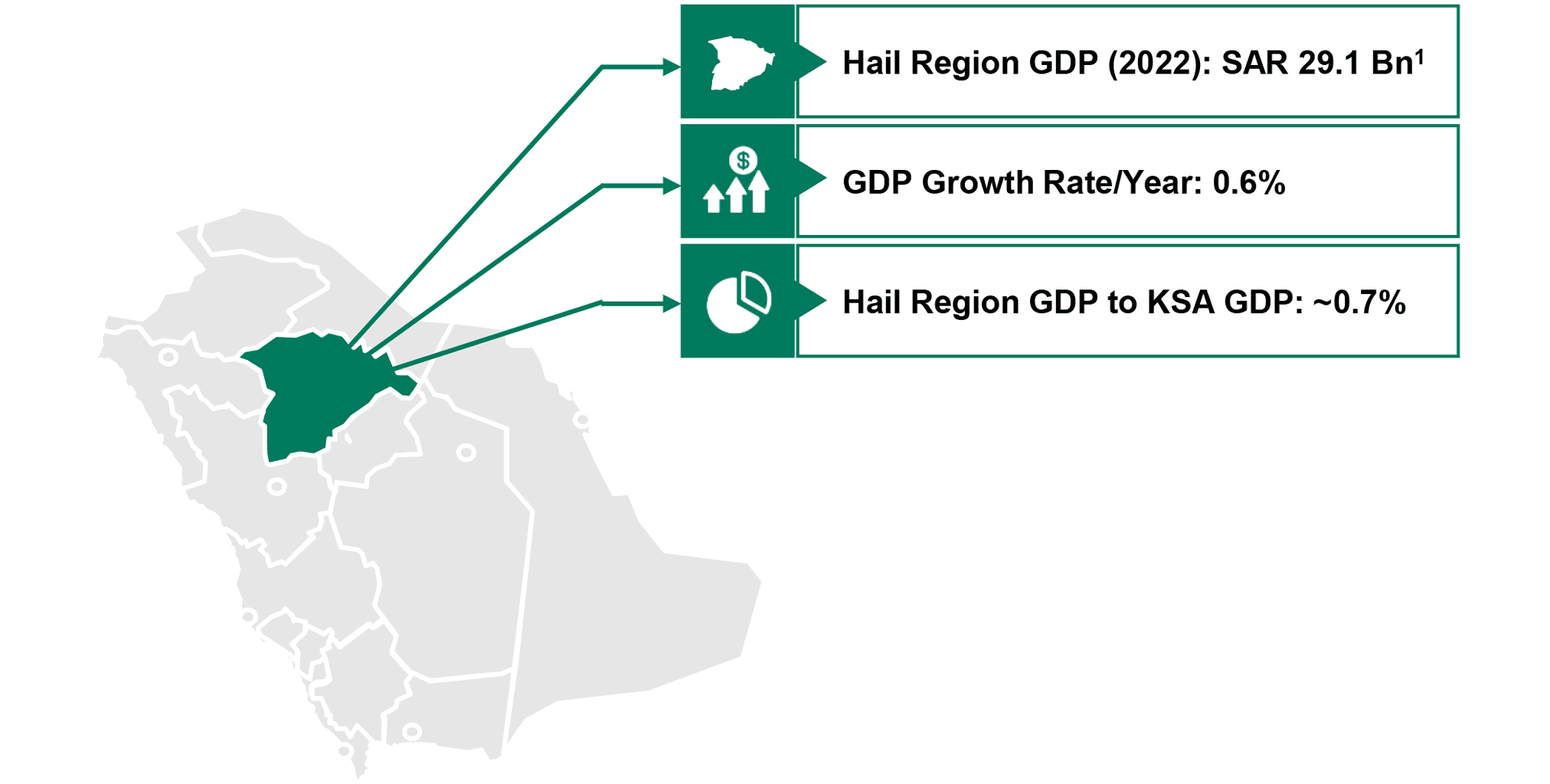

Hail’s GDP reached SAR c. 29.1 Bn in 2022, 1.3% of the Kingdom’s GDP, supported by 10 main sectors led by retail and trade, government services, construction and transport

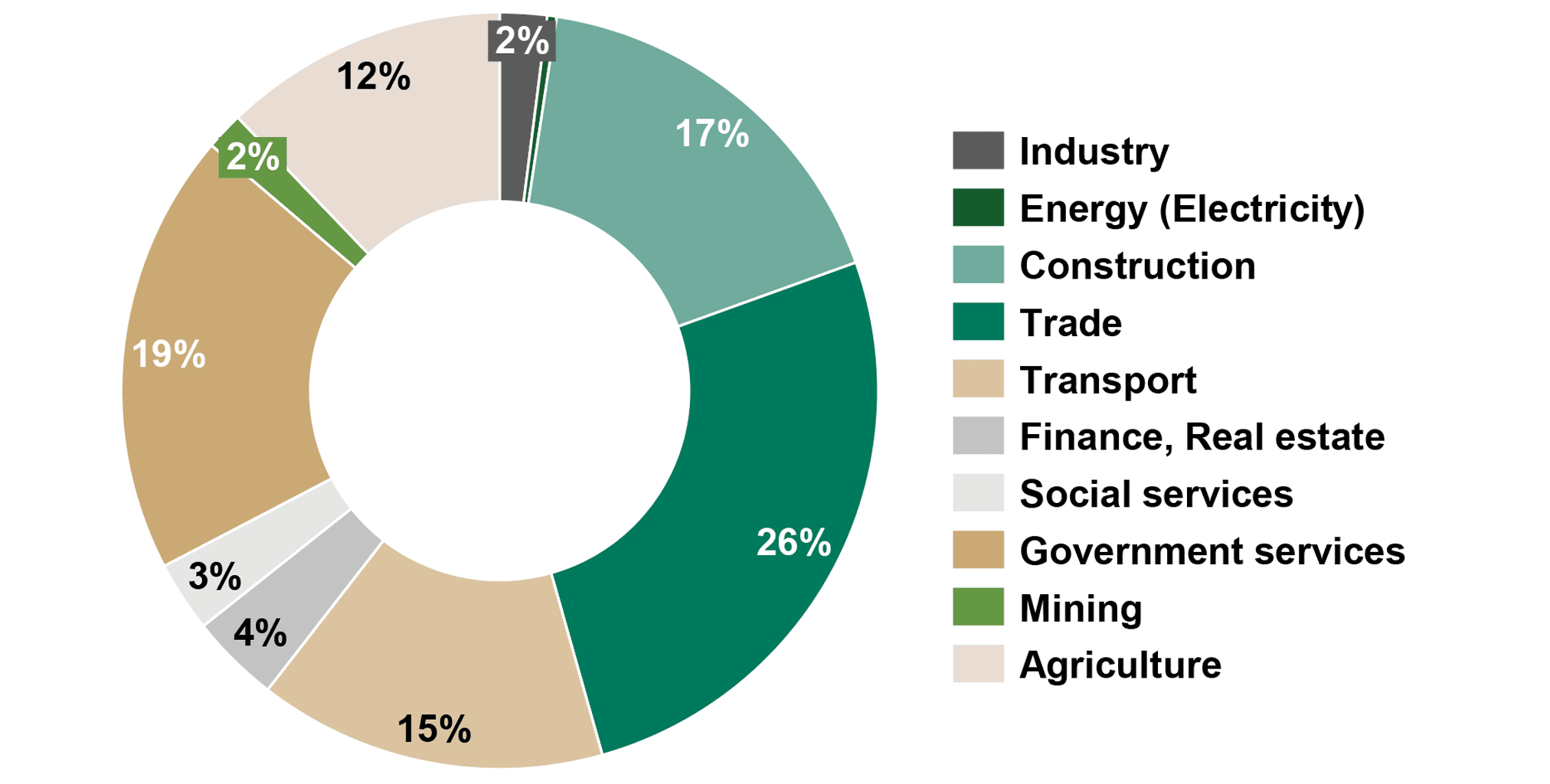

Hail region GDP Contribution, 2022

Economic Sector Contribution Hail region GDP, 2022

- In 2022 the Hail region GDP reached approximately SAR 29.1 Bn, a 0.6% growth per year.

- As part of the Kingdom’s GDP, Hail region GDP to KSA GDP accounted for around 0.7% in 2022.

- 10 main sectors contribute to Hail region’s GDP, led mainly by the retail and trade sector at 26% of the region GDP, Government services at 19%, Construction at 17% and 15% for Transport, with other sectors following.

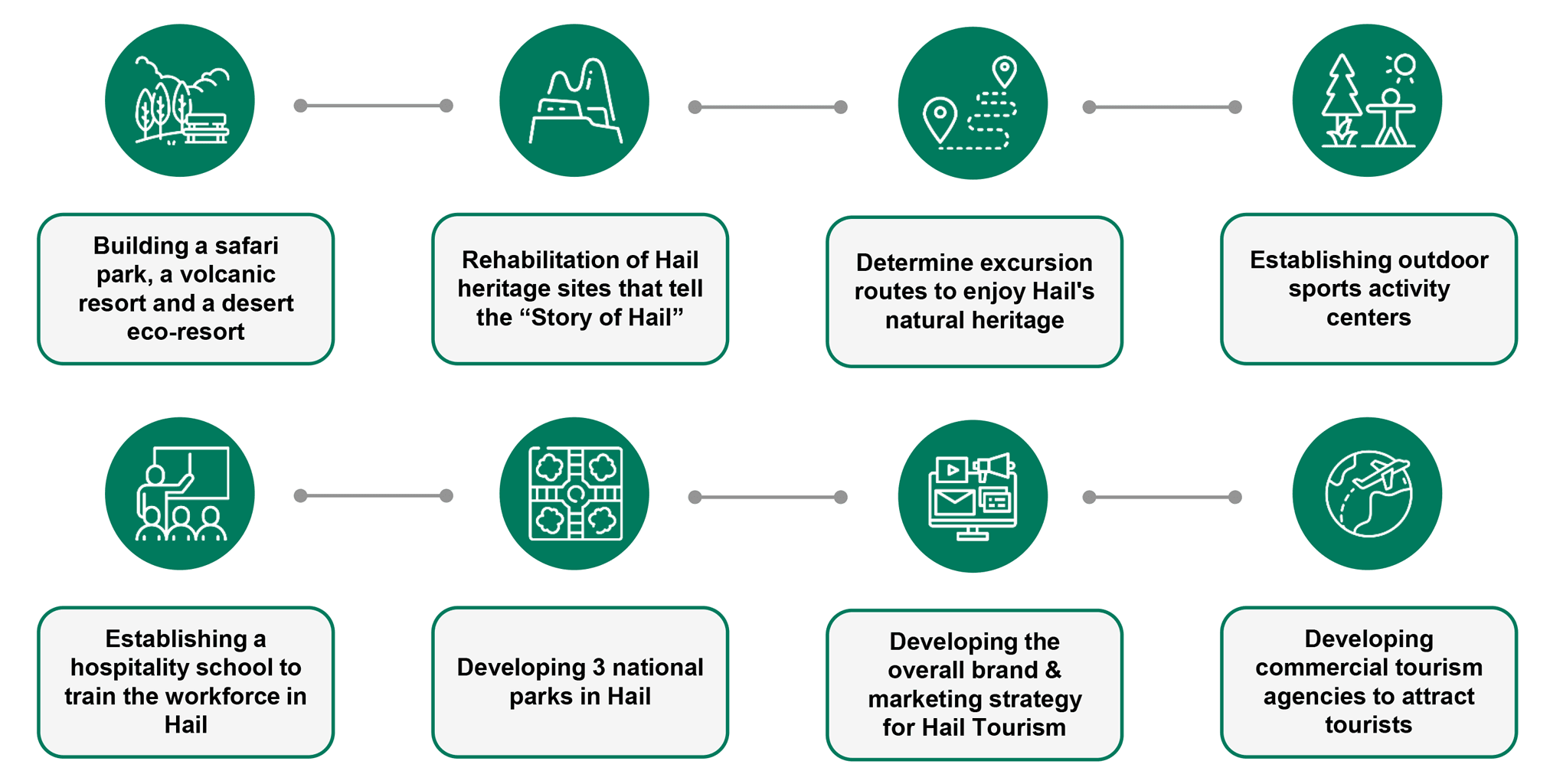

In line with Vision 2030, the government has launched multiple initiatives to boost the tourism sector in Hail province as a priority sector in the region.

TOURISM IN THESAUDI VISION 2030

As part of the kingdom’s efforts to build a sustainable and welcoming economy, The Saudi Vision 2030 aims at developing Tourism as one of the key industries that play a crucial role in economic and social developments, as well as improving internal tourism.

Multiple initiatives have been launched to boost the tourism sector in Hail province as one of the prioritized sectors for the region.

This has translated into an increase in visitor numbers and spending in Hail region, both of which are anticipated to continue significant growth in the foreseeable future.

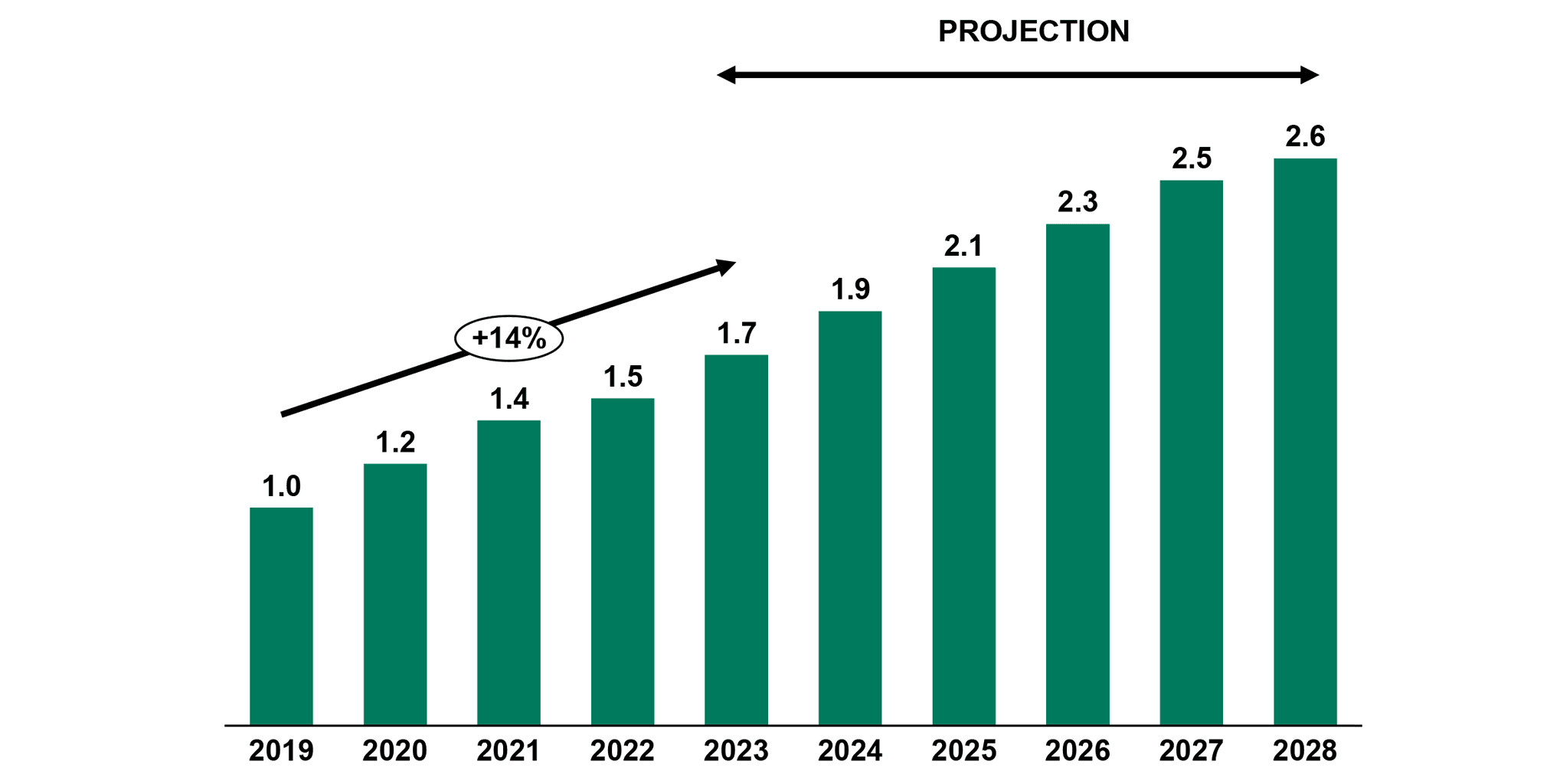

Visitor Trips to Hail, 2019 – 2028

Mn,#

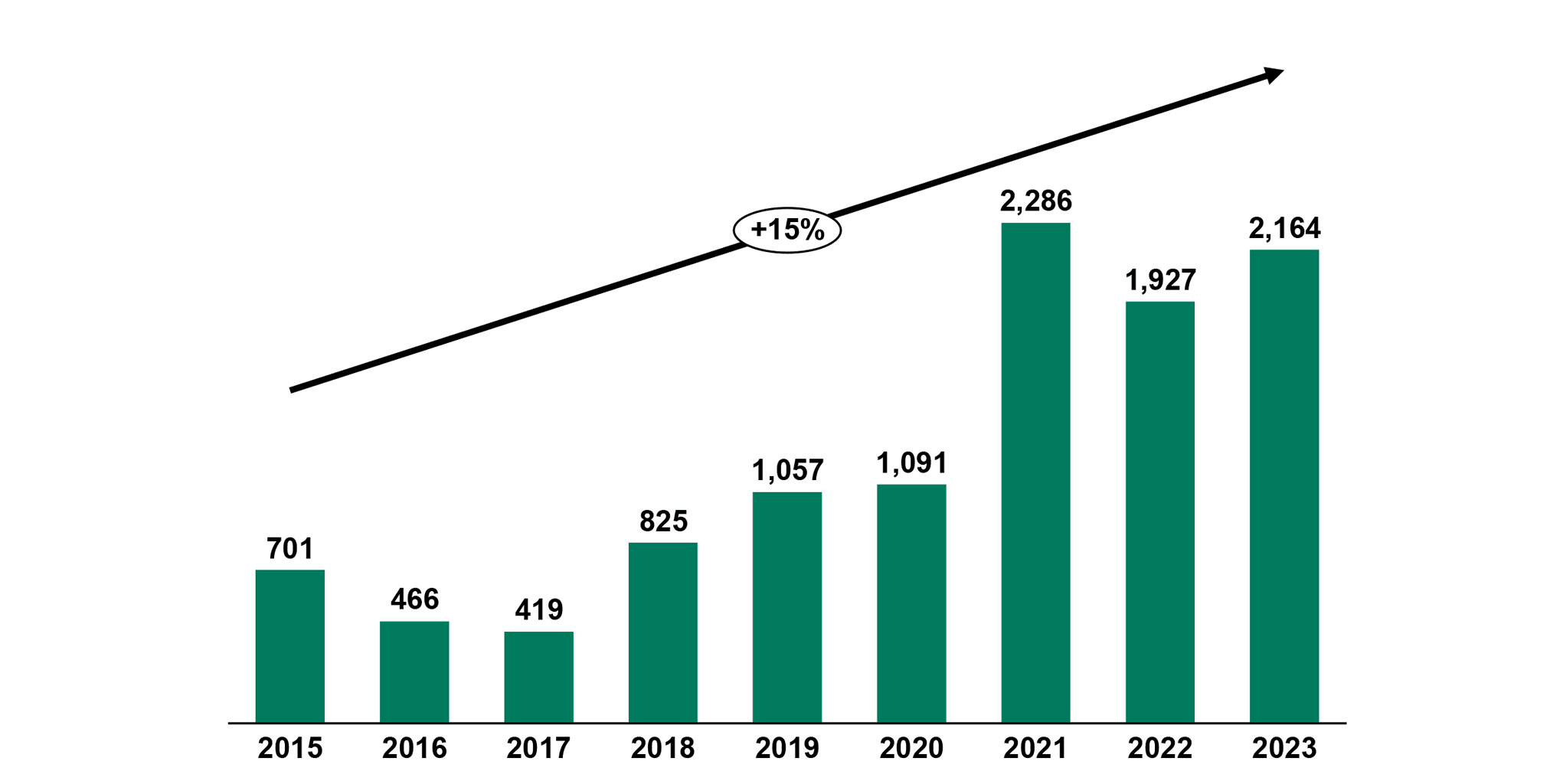

Visitors’ Expenditure in Hail, 2015 – 2023

SAR Mn

- Key sectors driving growth in Hail include agriculture, food processing, logistics, manufacturing, and tourism.

- Tourism witnessed significant growth at a compounded annual growth rate of 14% during the period from 2019 to 2023, resulting in increased visitor trips and higher spending, reaching SAR 2.3 bn in 2021 and is expected to rise to SAR 2.6 Bn by year 2025.

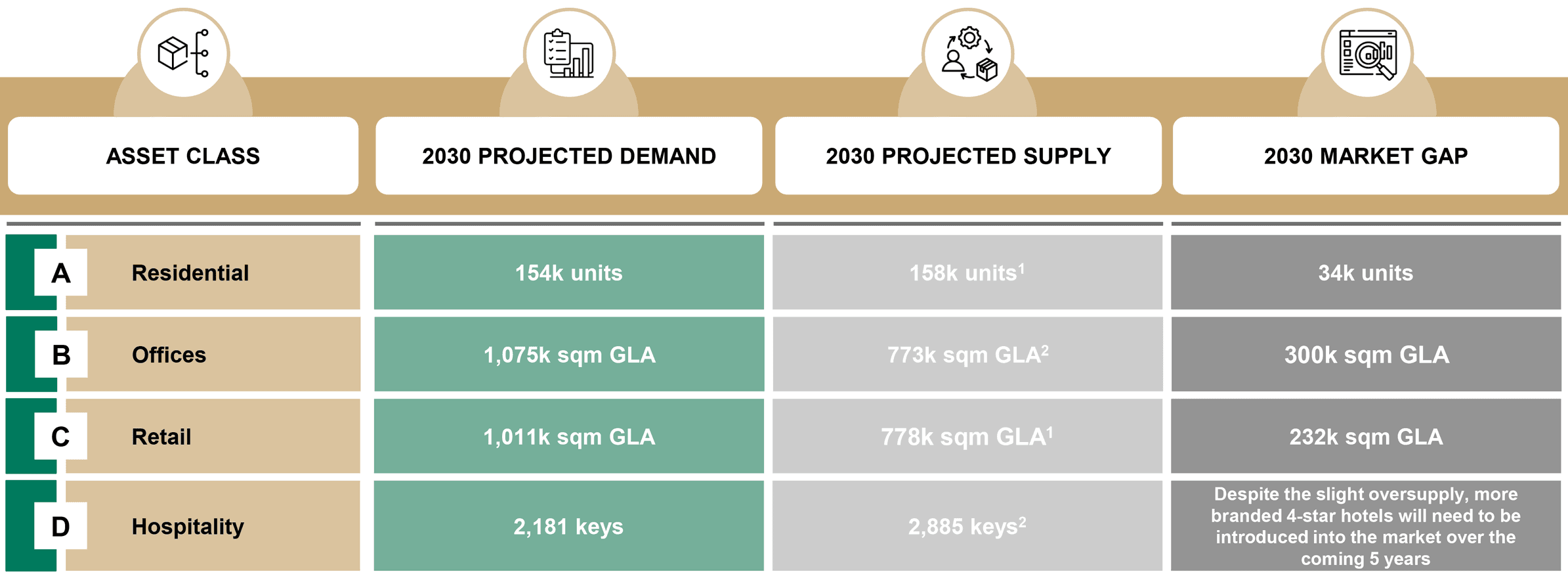

Consequently, Hail is expected to experience a significant supply gap in essential real estate segments, creating opportunities for new investments to bridge the market gap and enhance the quality of offerings.

Market Gap Snapshot across the Real Estate sector classes in Hail

Notes:

1 At 75% materialization; 2 At 100% materialization

In the retail segment, Hail is moving towards more modern retail concepts, focusing on areas that can enhance the experience of shoppers.

Retail Evolution in Hail

- Mixed-use developments around the One-stop shop malls present an opportunity to attract consumers from nearby catchment areas, serving the local community by providing a mix of services and products

- Community-led centers, FEC, and Leisure could be the new form of concept and experience that can attract a wider range of shoppers and footfall

- Developing unique destination retail souks that maintain the local heritage and tradition of the city, whilst also offering outlets such as restaurants and cafés to appeal to a broad audience and potential customers, families, and children as a catchment base

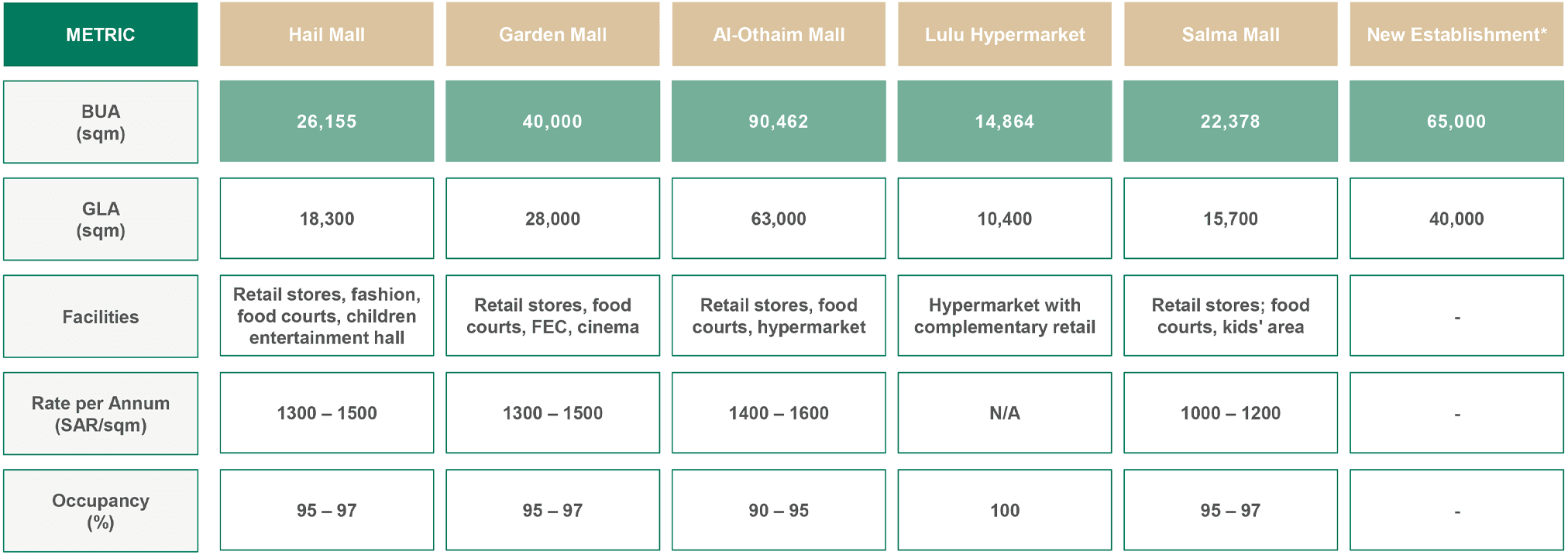

To better understand the current supply and identify characteristics of key malls in Hail, a benchmarking exercise was conducted, suggesting the lack of fashion outlets in Hail’s retail market.

- Al-Othaim mall has both the largest BUA and GLA in the existing retail landscape in Hail.

- Rental rates fluctuate from SAR 1000/sqm per annum to 1600/sqm per annum depending on the shop location, mall facilities and catchment area.

- Lulu Hypermarket has the highest occupancy rate whereas occupancy rates of 95 to 97% are common in the retail landscape of chosen benchmarks.

- Garden Mall is the only benchmark having fashion outlets, suggesting a gap in the market where fashion outlets can be opened in a mall.

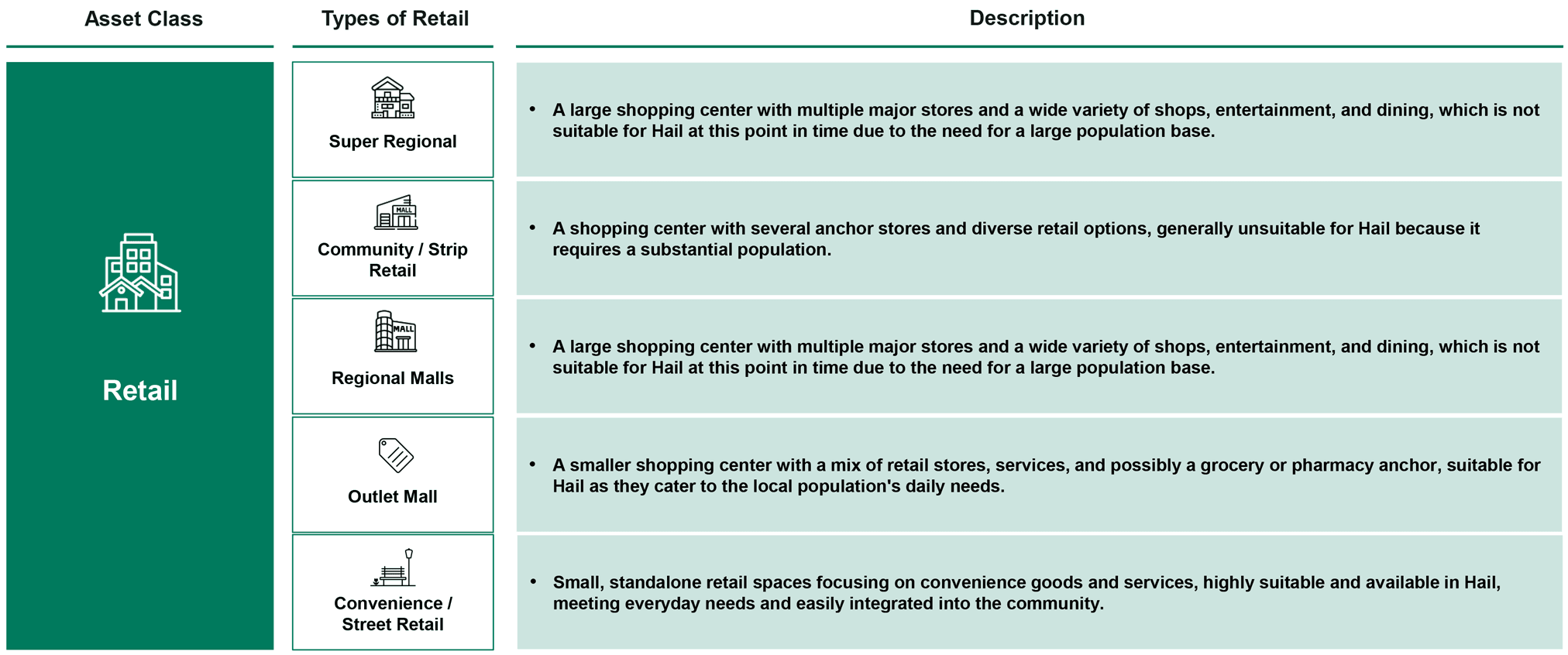

Additionally, a taxonomy for the retail malls was undertaken for Hail’s market to explore the offering options, ranging from super regional and regional, to community, outlet and convenience malls.

Retail Malls Taxonomy in Hail

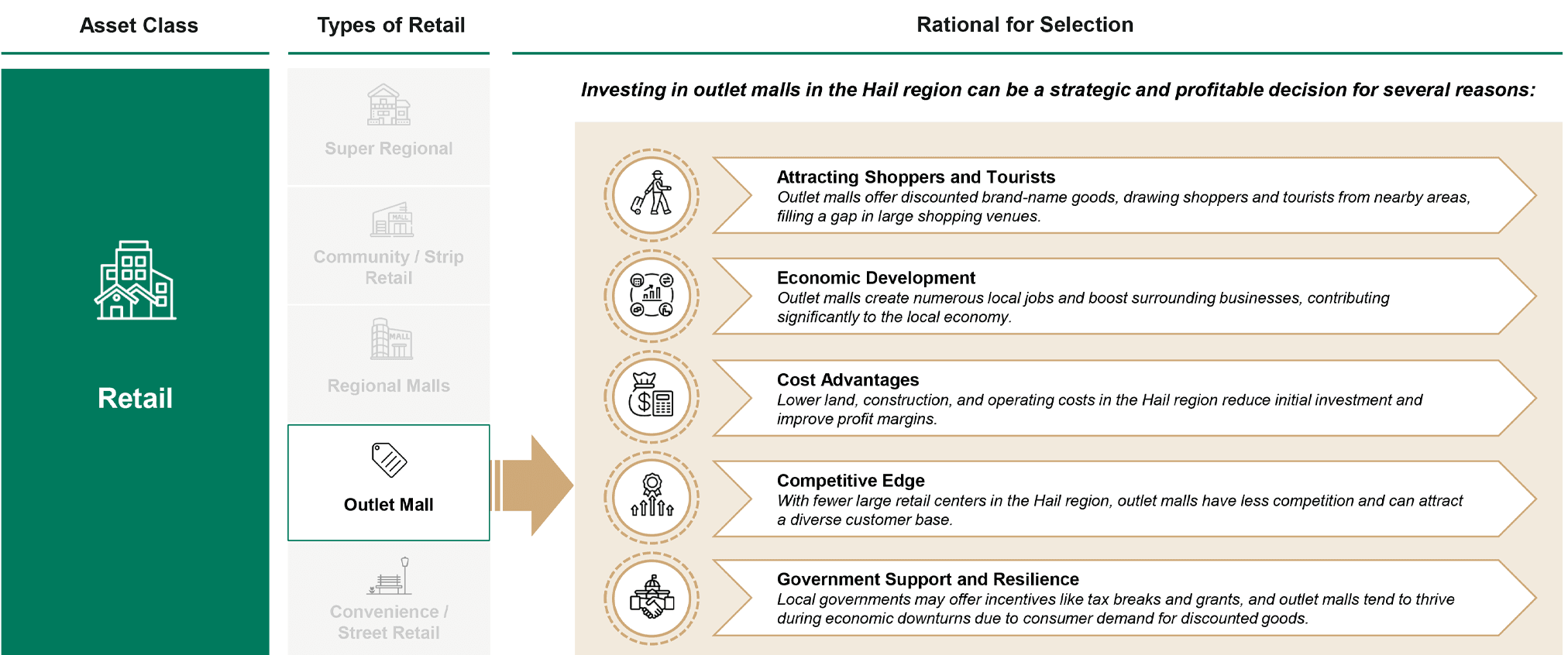

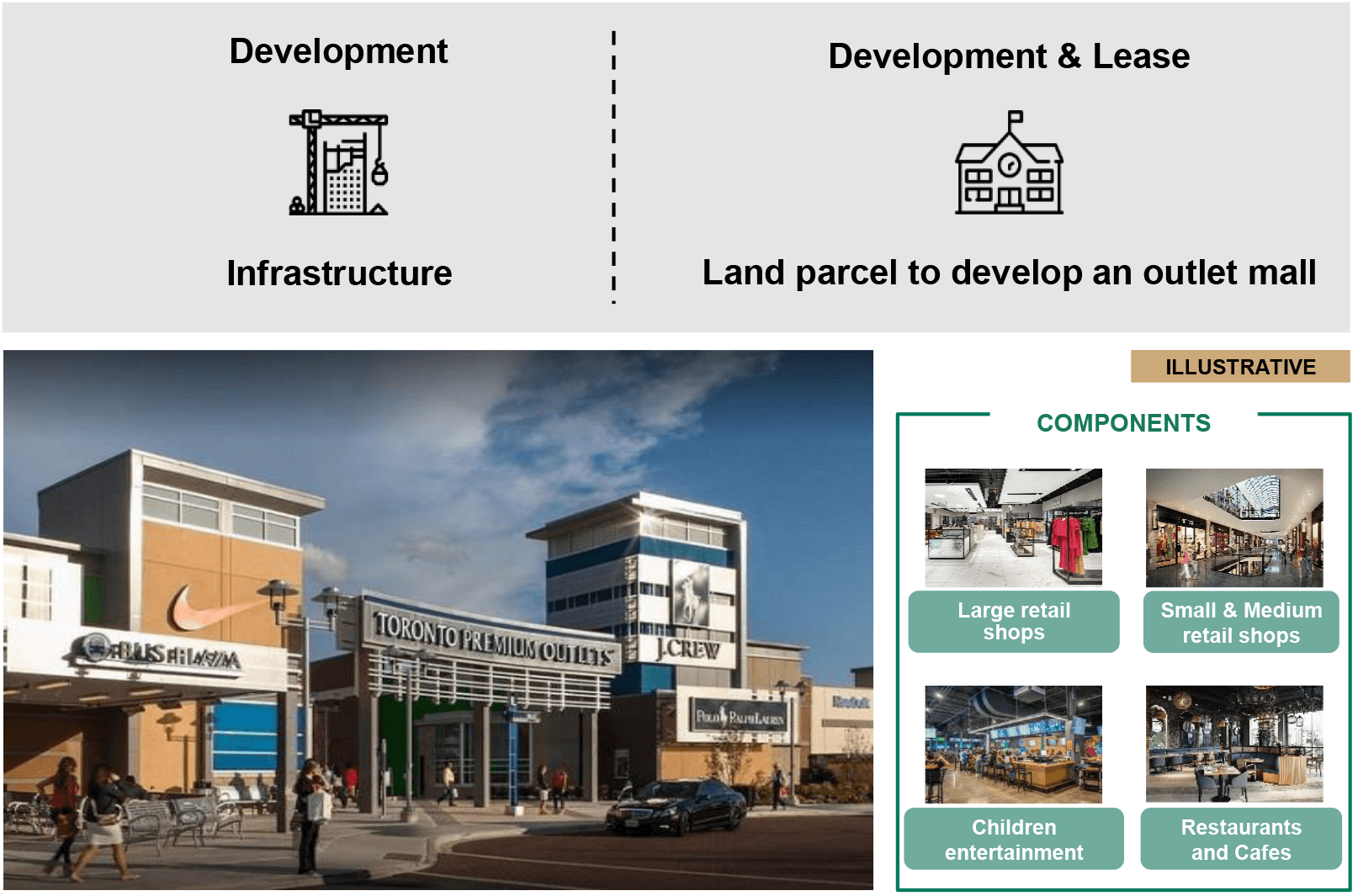

As a consequence, outlet mall option is selected given its strategic importance for tourist attraction, boosting economic development in Hail while leveraging cost advantages and government support.

Retail Malls Taxonomy in Hail

As a result, the development of a mid-sized outlet mall will drive social and economic growth and enhance opportunities in Hail city.

Medium-sized Outlet Mall

This outlet mall destination features four distinct areas, each offering a unique blend of shopping, dining, and entertainment. Visitors can enjoy browsing major retail stores, discovering specialty shops, and savoring food and beverages. The project also caters to families by providing attractive entertainment options for children. This outlet mall embraces both the heritage and modernity of Hail, promising a comprehensive experience. The sizes of the commercial mall plots range from over 25,000 square meters for small shopping centers to up to 1,200,000 square meters for large commercial centers.

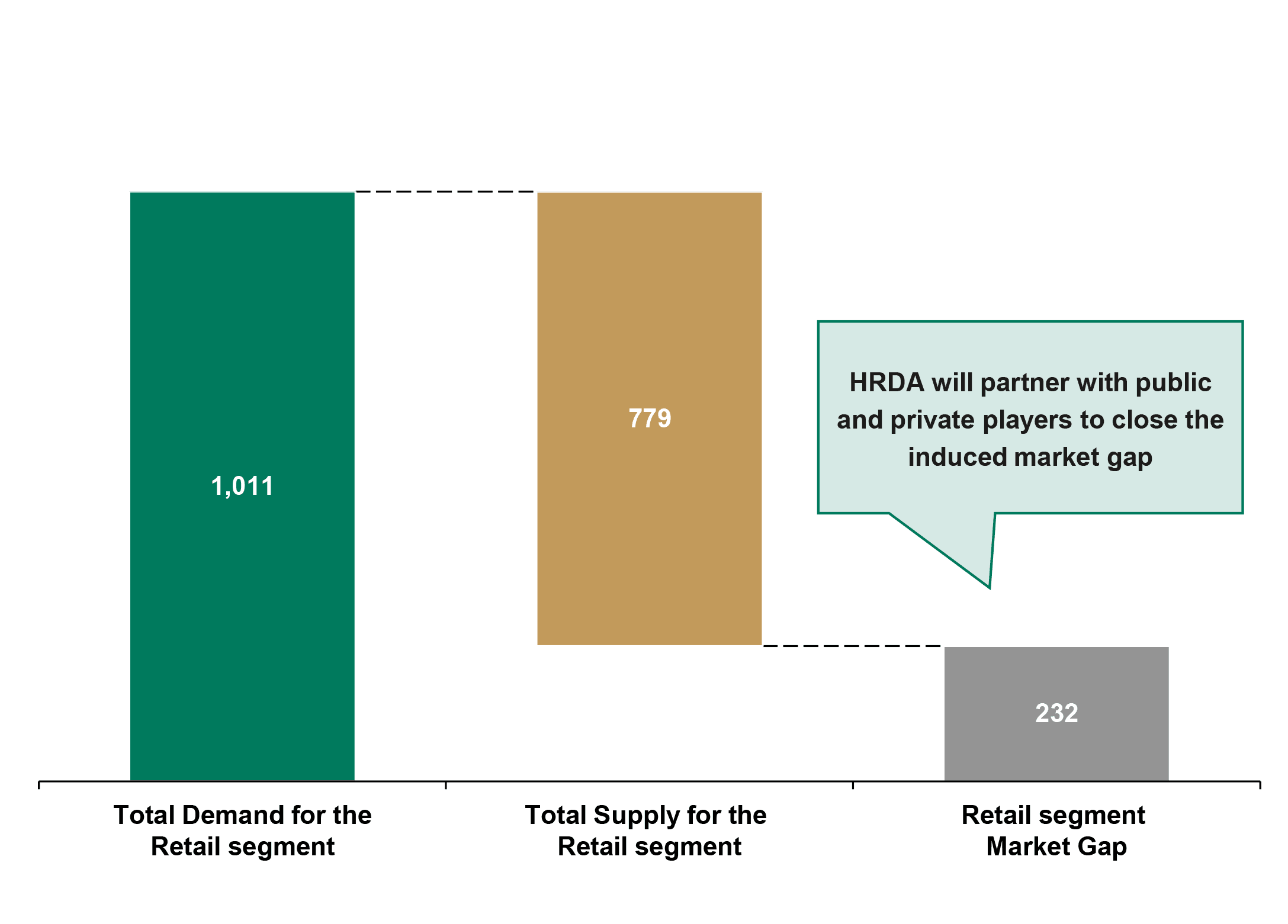

This is highlighted by a shortfall of 232k sqm in GLA, underscoring the need to introduce more offerings by HRDA as well as a multitude of other public and private entities.

Market Gap for Retail Segment in Hail by 2030

Thousands sqm of GLA

REMARKS

- Considering the burgeoning retail landscape in Hail, projections suggest that by 2030, there will be a substantial shortfall of 232k sqm in retail space.

- To effectively address this shortfall, HRDA will embark on strategic initiatives, including the development of new retail complexes and collaborative ventures with private stakeholders to establish Regional Malls, Community Malls, and Leisure & Entertainment Facilities, representing 75% materialization.

- These endeavors aim to not only bridge the gap in retail infrastructure but also to meet the escalating demand fueled by the city’s expanding population and the influx of tourists and visitors.

- In doing so, HRDA seeks to enhance the retail experience in Hail, stimulate economic growth, and create vibrant spaces that cater to the diverse needs and preferences of residents and visitors alike.

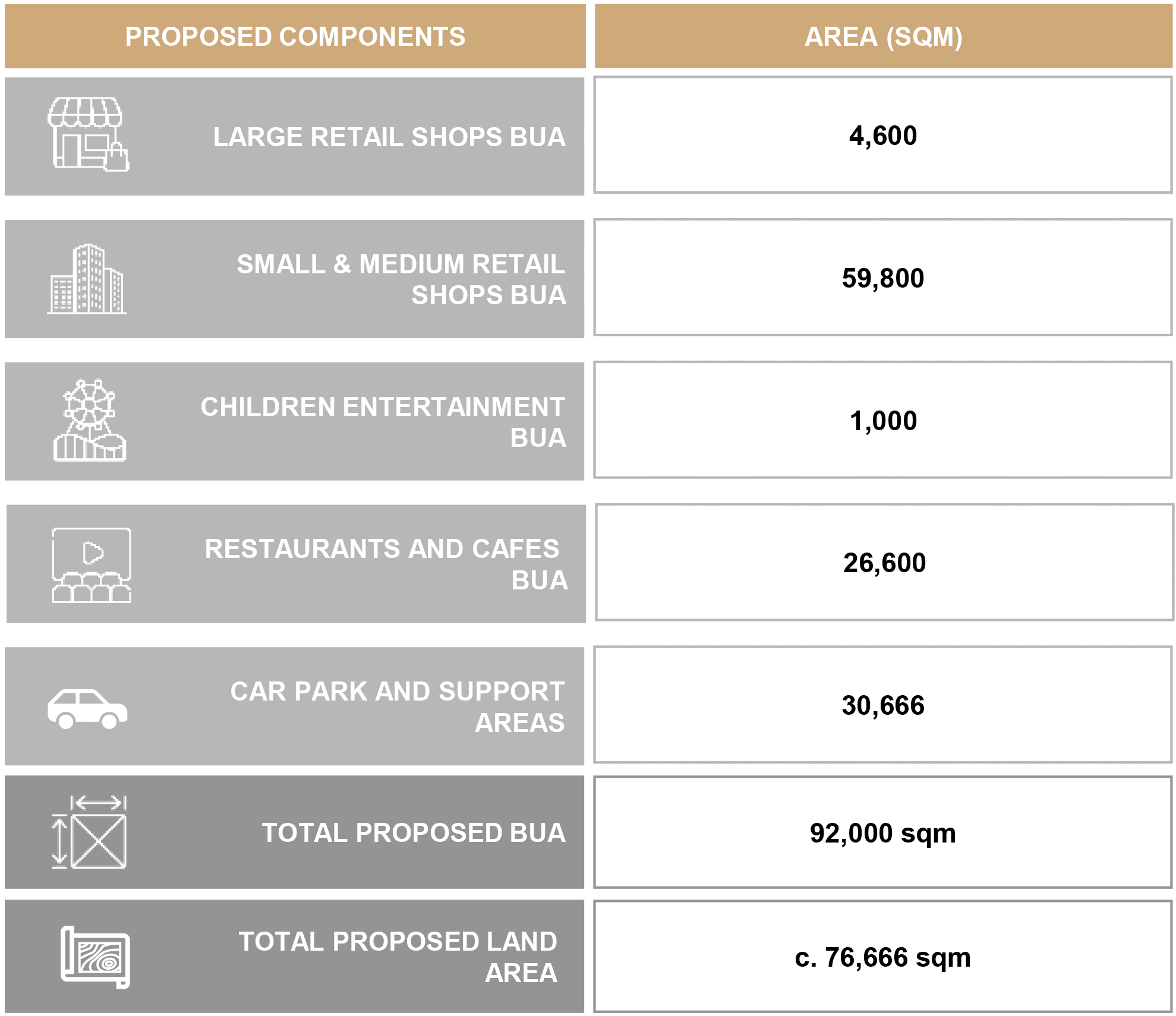

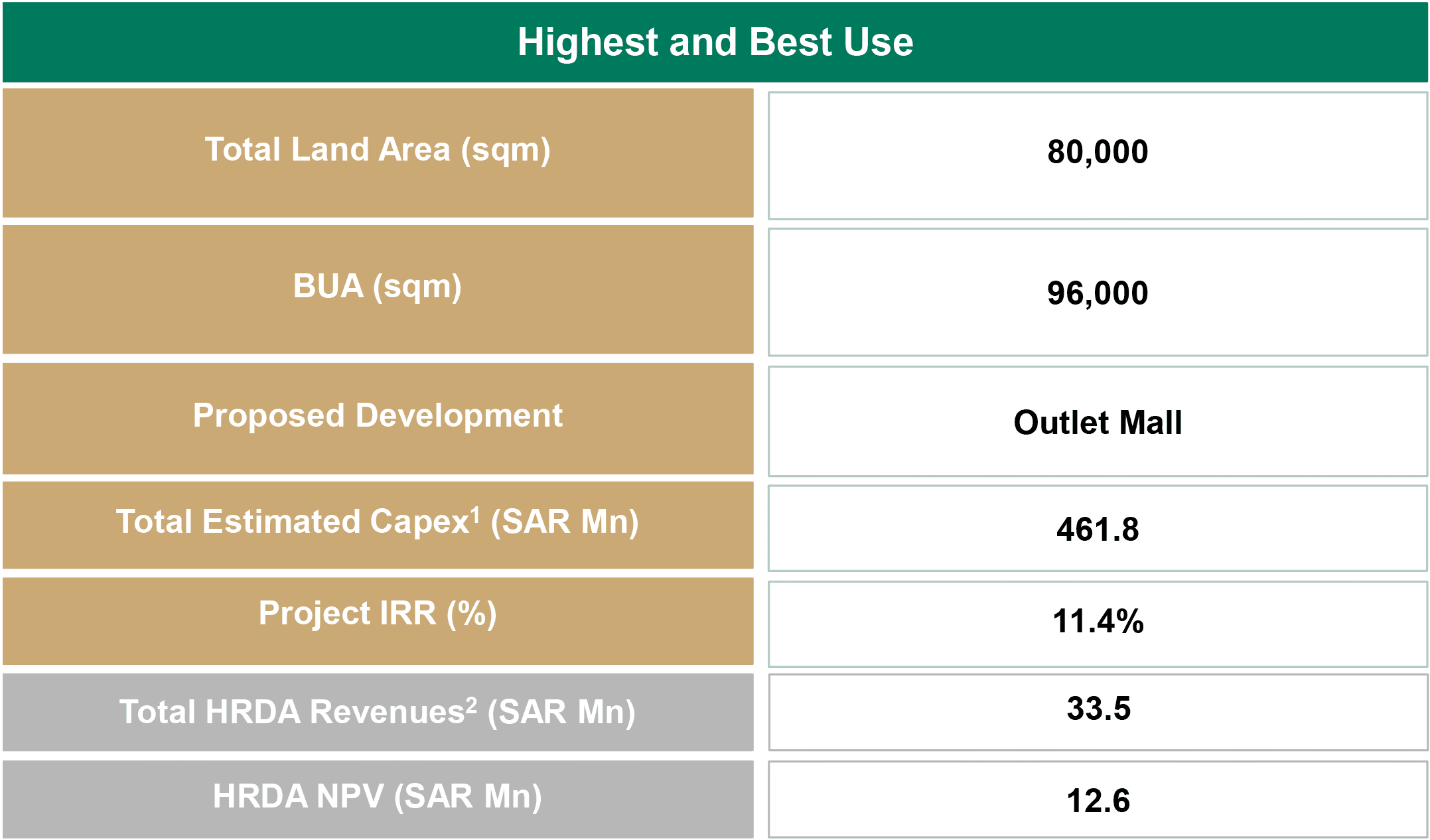

In this context, HRDA seeks to develop an outlet mall on a land plot in Hail within its masterplan in Al-Naqra district, covering an area of 80,000 sqm.

Outlet Mall Investment Opportunity

Project Duration (25 years including 2-years for construction)

- The proposed outlet mall on the plot is expected to meet the retail sector needs of the city and its surroundings.

1-Does not include the land cost as the project is based on the land leasing model

2-During the operating period of the project

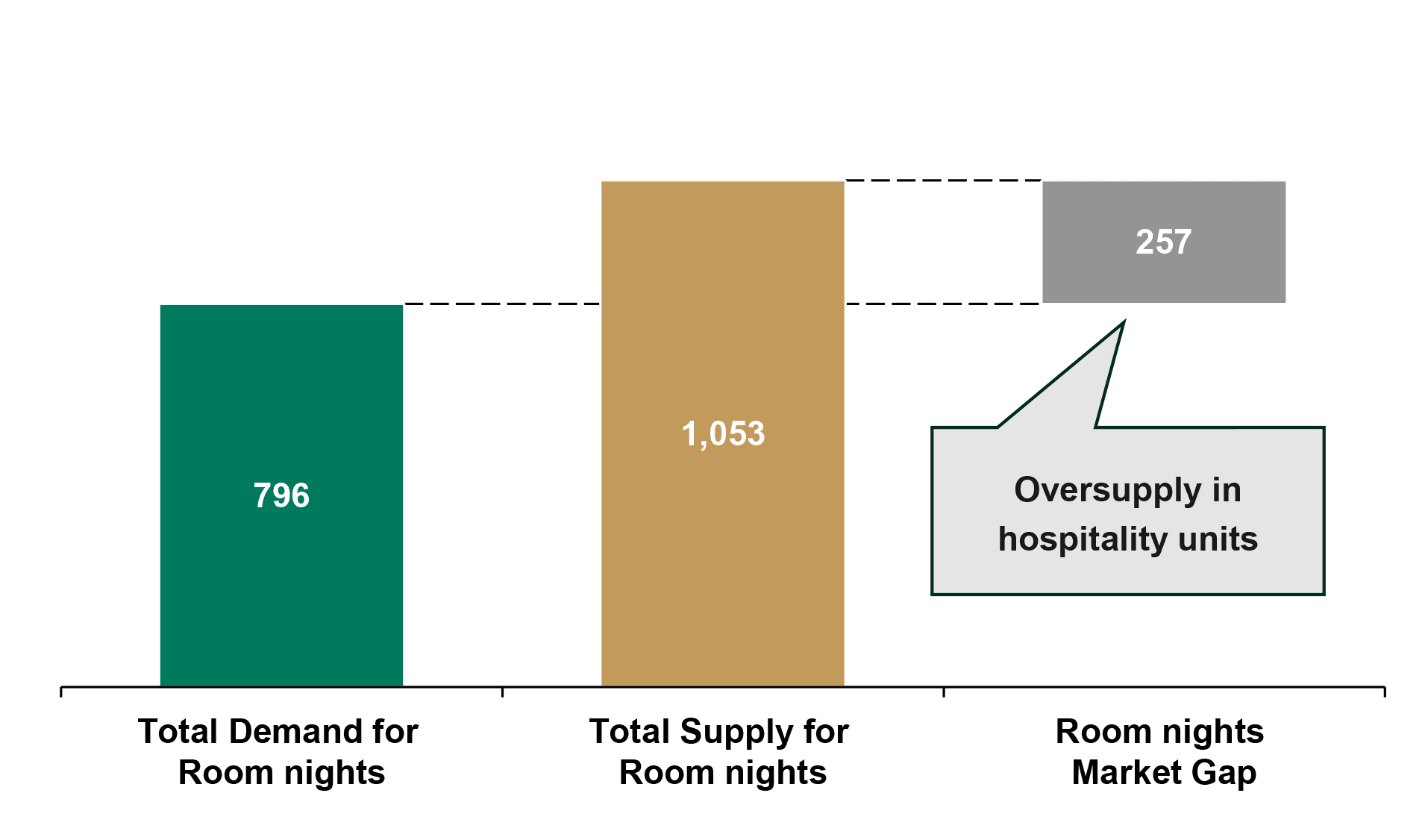

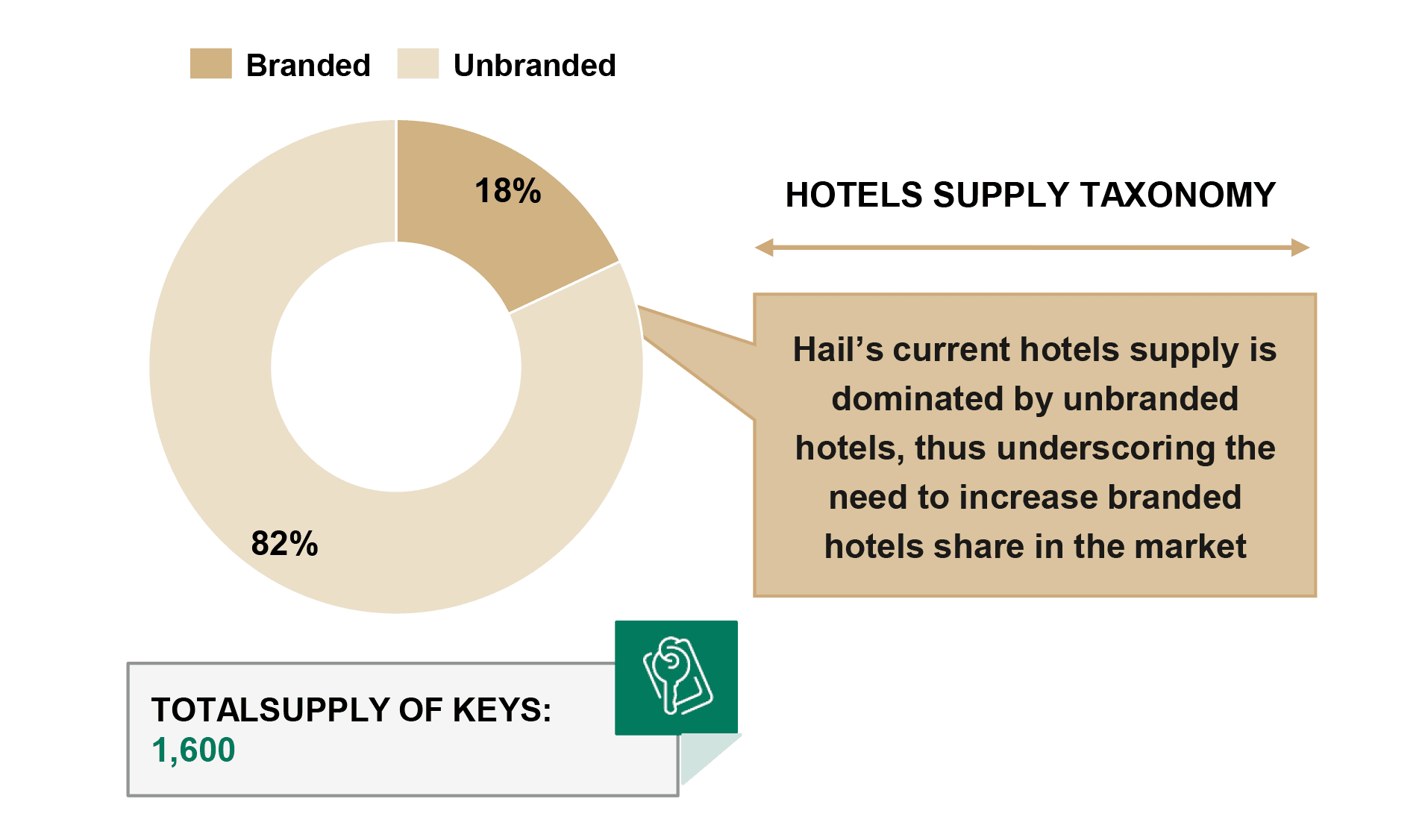

Hail’s hospitality market faces an oversupply of unbranded hotels, which presents the opportunity to introduce branded hotels and upgrade the quality of offerings in Hail.

Market Gap for Hospitality Segment in Hail by 2030

Room nights thousands

Current Supply of Hospitality Segment Offerings in Hail

Room nights thousands

- The current market situation in Hail reveals an oversupply of hospitality facilities, particularly in the 3-star hotel segment.

- Unbranded hotels constitute approximately c.80% of the market, highlighting an opportunity to introduce branded hotels to elevate the overall quality of accommodations.

- By providing modern amenities, superior services, and a trusted brand reputation, these hotels can cater to the growing demand from both domestic and international travelers, thereby contributing to the overall economic development of Hail.

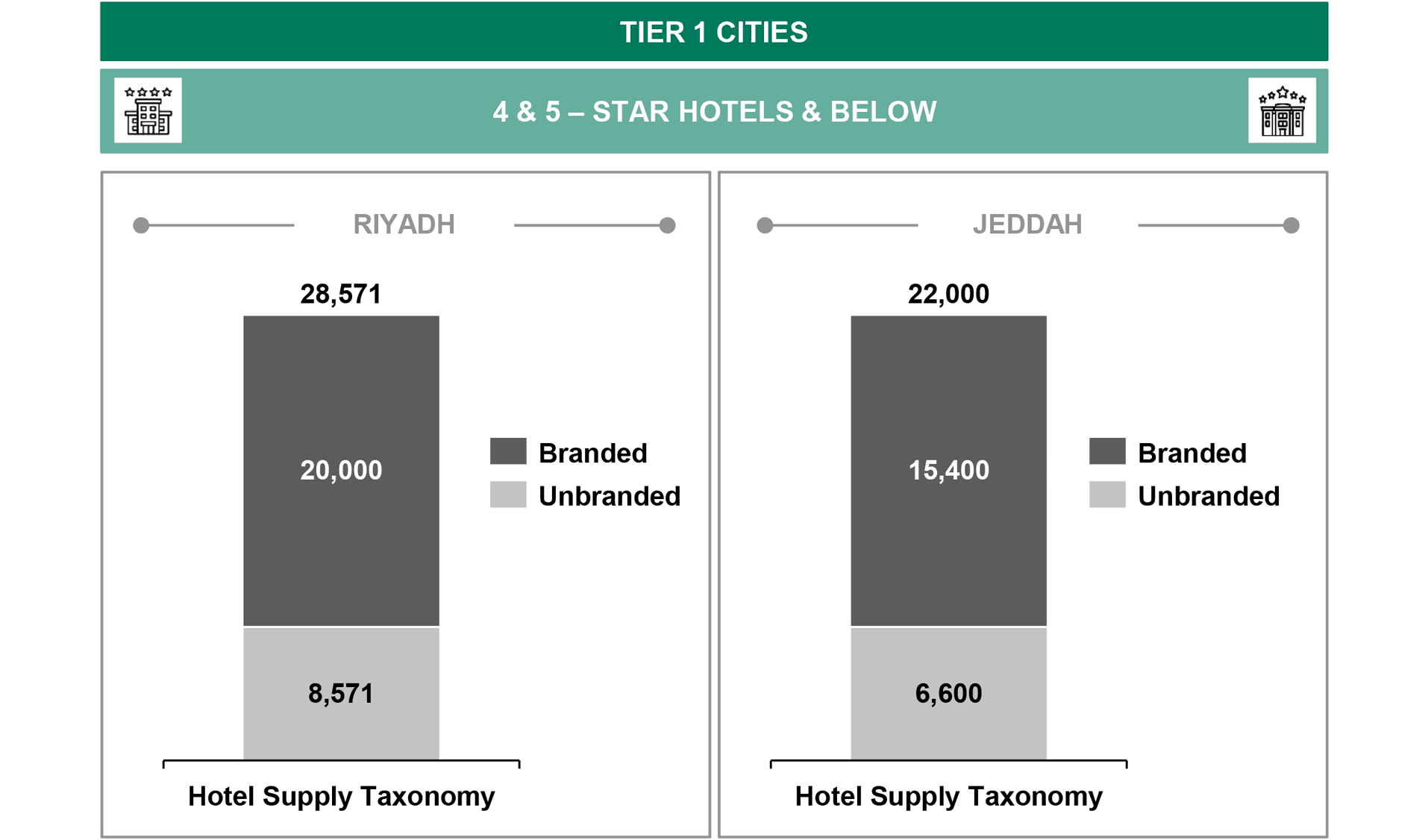

This will result in a growing need to attract branded hotel operators to Tier 2 regions like Hail, in line with the socio-economic transformation of KSA, spearheaded by Tier 1 regions.

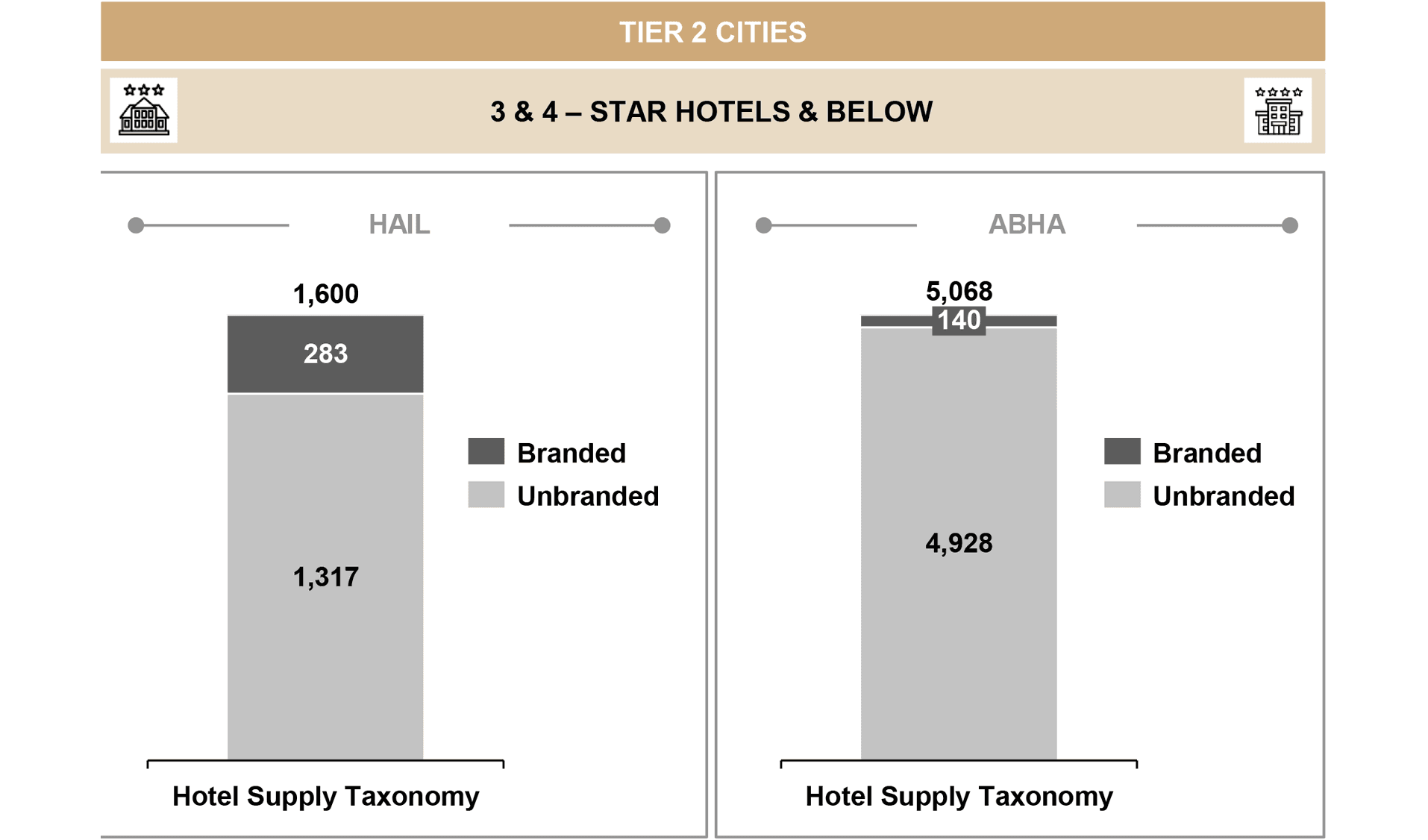

Comparative Analysis for Hotels supply in Tier 1 and Tier 2 Cities of KSA, 2023

- Tier 1 cities rely heavily on the branded hotels to accommodate international tourists and visitors with high quality offerings (c.80%), similar to Riyadh and Jeddah.

- Tier 2 cities are predominantly relying on the locally unbranded hotels which serve the current tourists pool, mostly made up of domestic travelers.

- With the planned socio-economic uplifting of KSA regions, Tier 2 cities are expediting the efforts to upgrade the quality of hospitality offerings by attracting international operators to cope up with the upscaling across the Kingdom, hence the need to introduce more branded offerings.

Originally, the landowner allocated the land for the development of a water reservoir ensuring certain socio-economic considerations for Hail region.

Historical Context

Asset Ownership and Developer Roles

Land Survey

Key Objectives

Socio-Economic Development for Hail:

- Enhance water infrastructure and connectivity across Hail.

- Optimize commercial utilization of an available land parcel and urban scenery.

- Ensure the sustainability and long-term viability of the site.

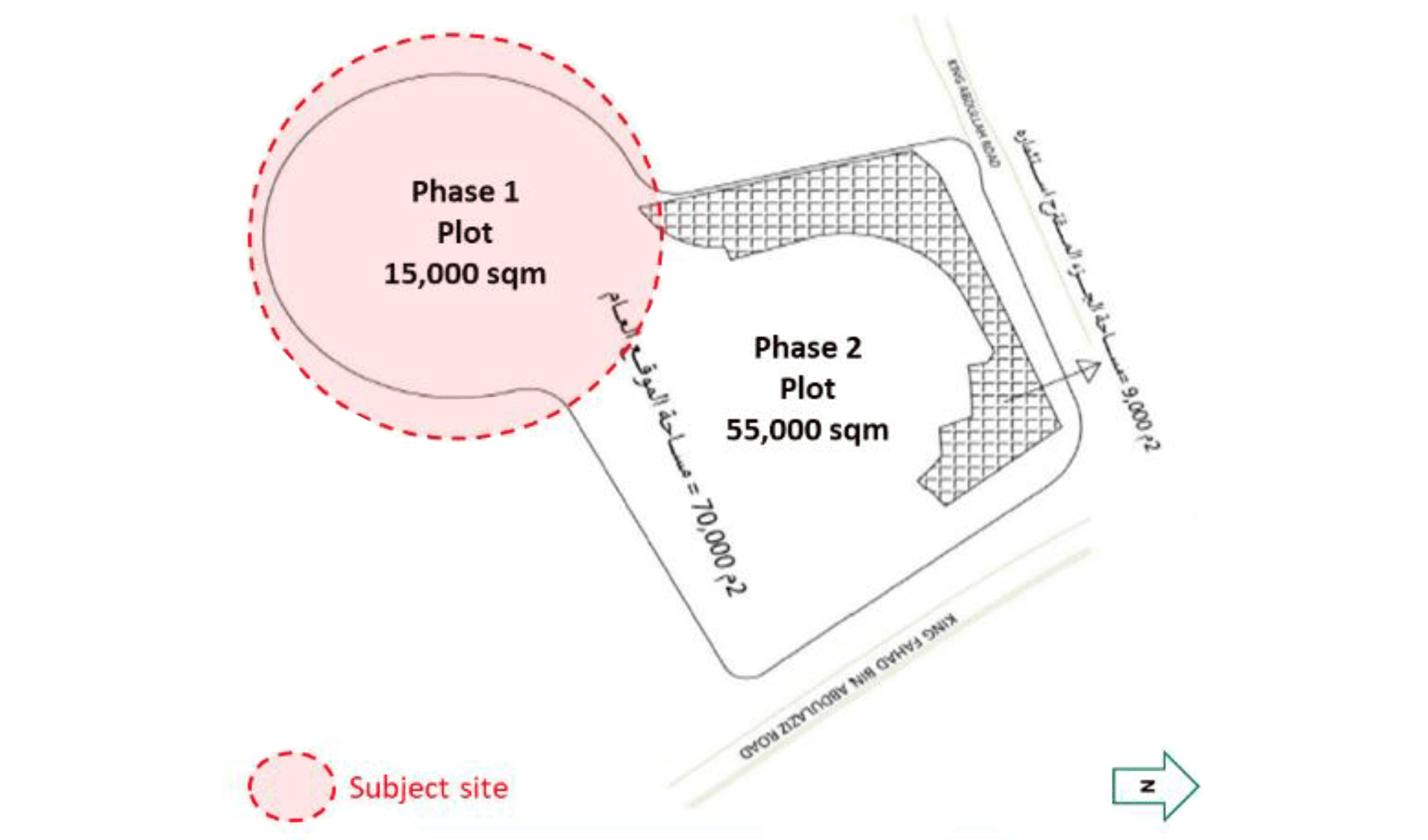

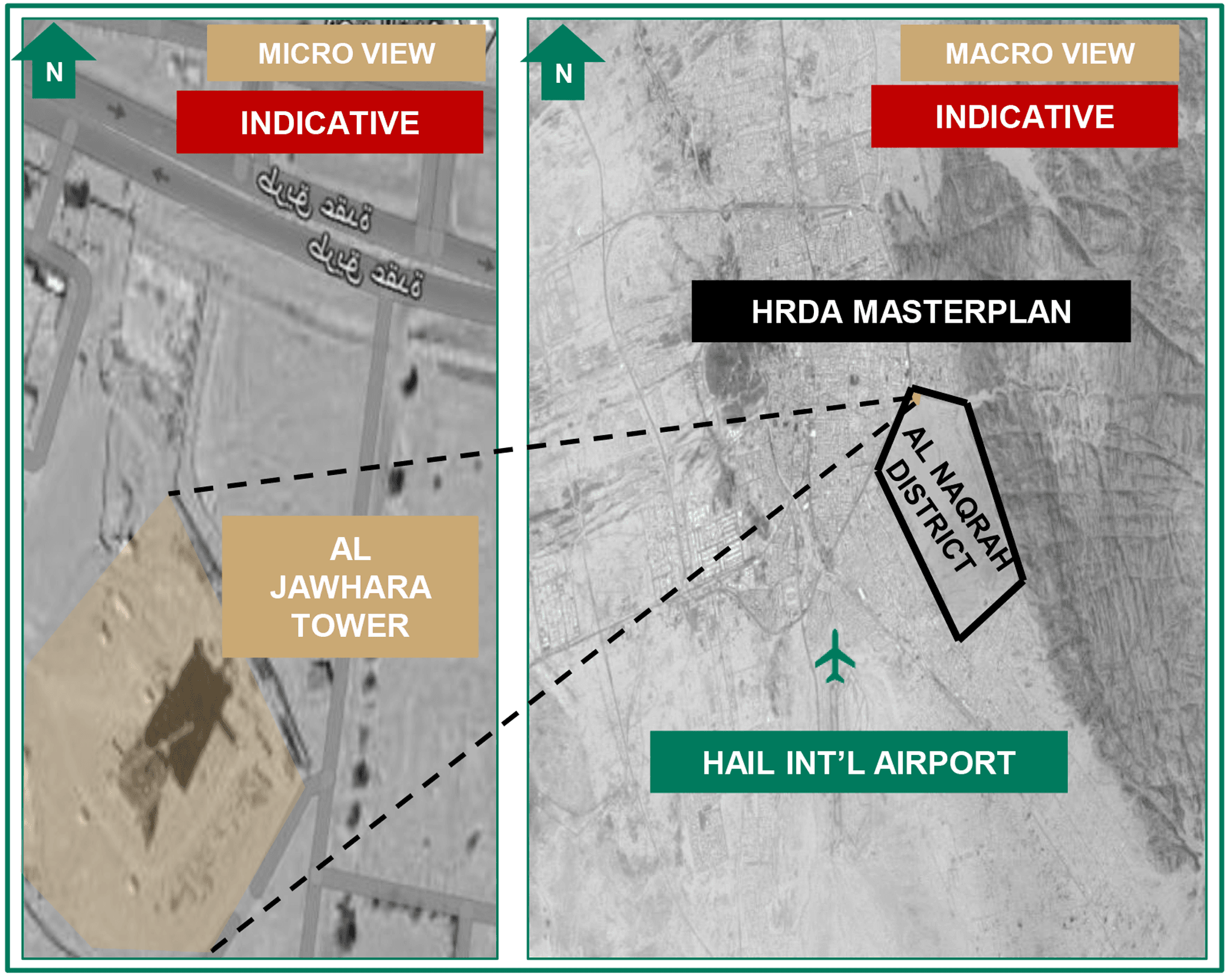

The landowner has since converted the first phase—Al Jawhara Tower—into a hotel project, which plays a crucial role in the master plan approved by the HRDA, rendering project completion to 71%

Al Jawhara Tower Layout

Al Jawhara Tower could become one of the most prominent hospitality projects, setting a new standard for tourism excellence in Hail. This modern tower enjoys a strategic location in the city’s urban expansion area, offering flexible rooms and suites, premium retail options, restaurants, cafes, meeting facilities, incentives, conferences, exhibitions, and top-notch amenities including lounges and panoramic views. It is expected to be a distinguished hotel tower designed to enhance productivity and provide a prestigious address for tourists and business travelers.

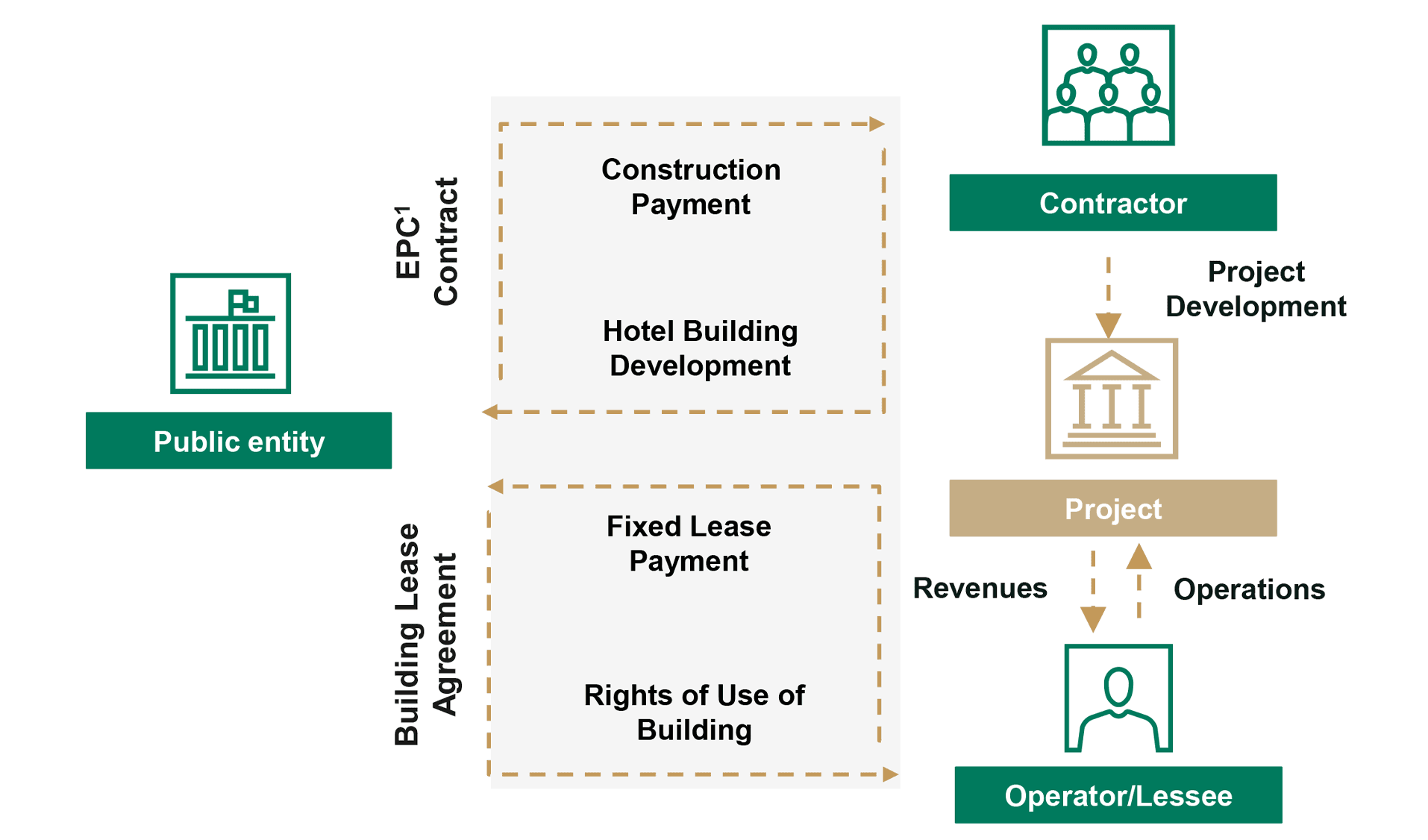

Under a Property Lease agreement, the landowner leases the property to the private sector partner who will manage equipping and operating the facility.

The landowner will contract with a contractor for development of the hotels and leases the property for private sector. Payment to the lessor is usually fixed over the contract term. In most cases, the property use is specified by the lessor and the lessee has to abide by it. The lease structure is the most commonly used model in utilizing public sector properties with the private sector.

1 Engineering, Procurement, and Construction

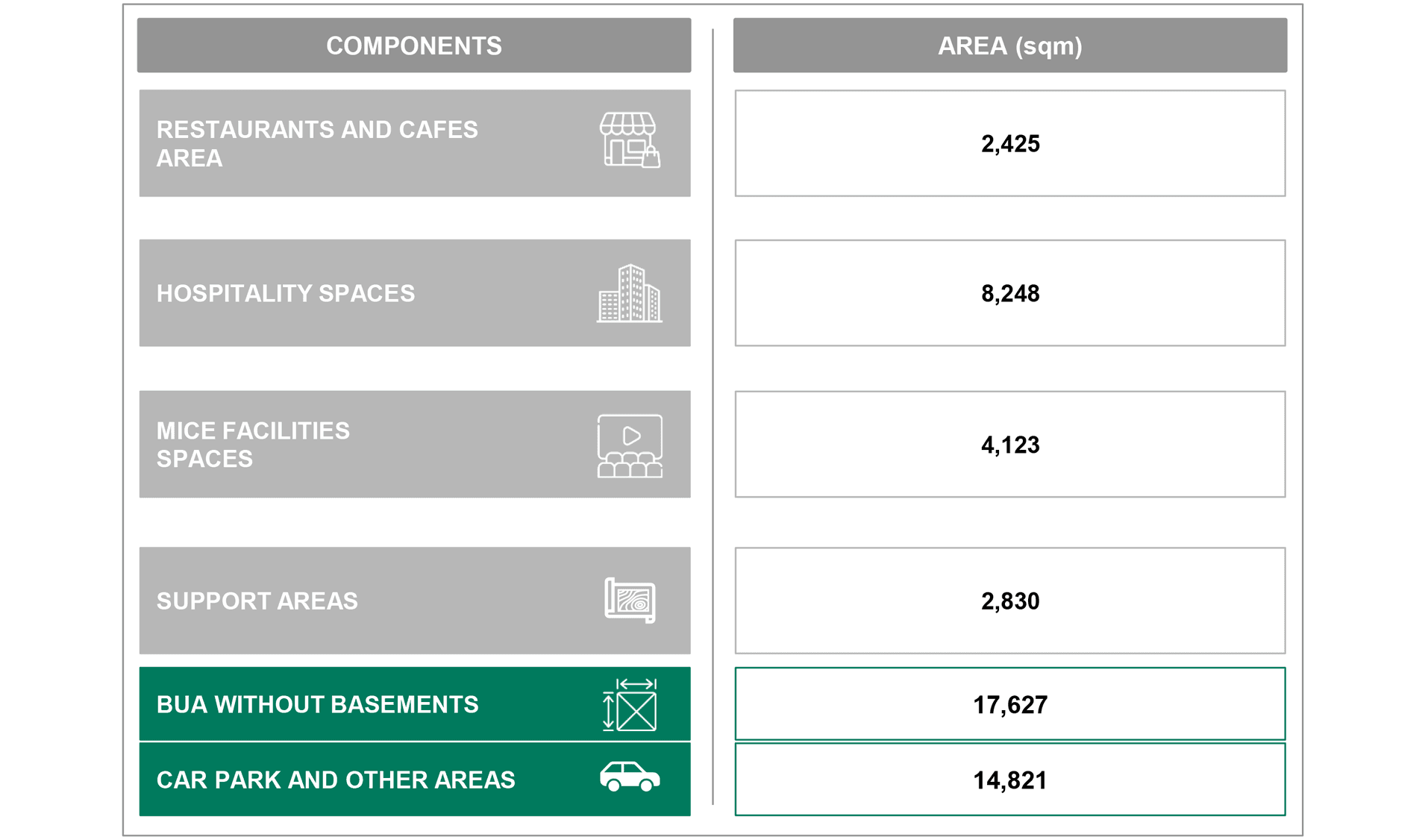

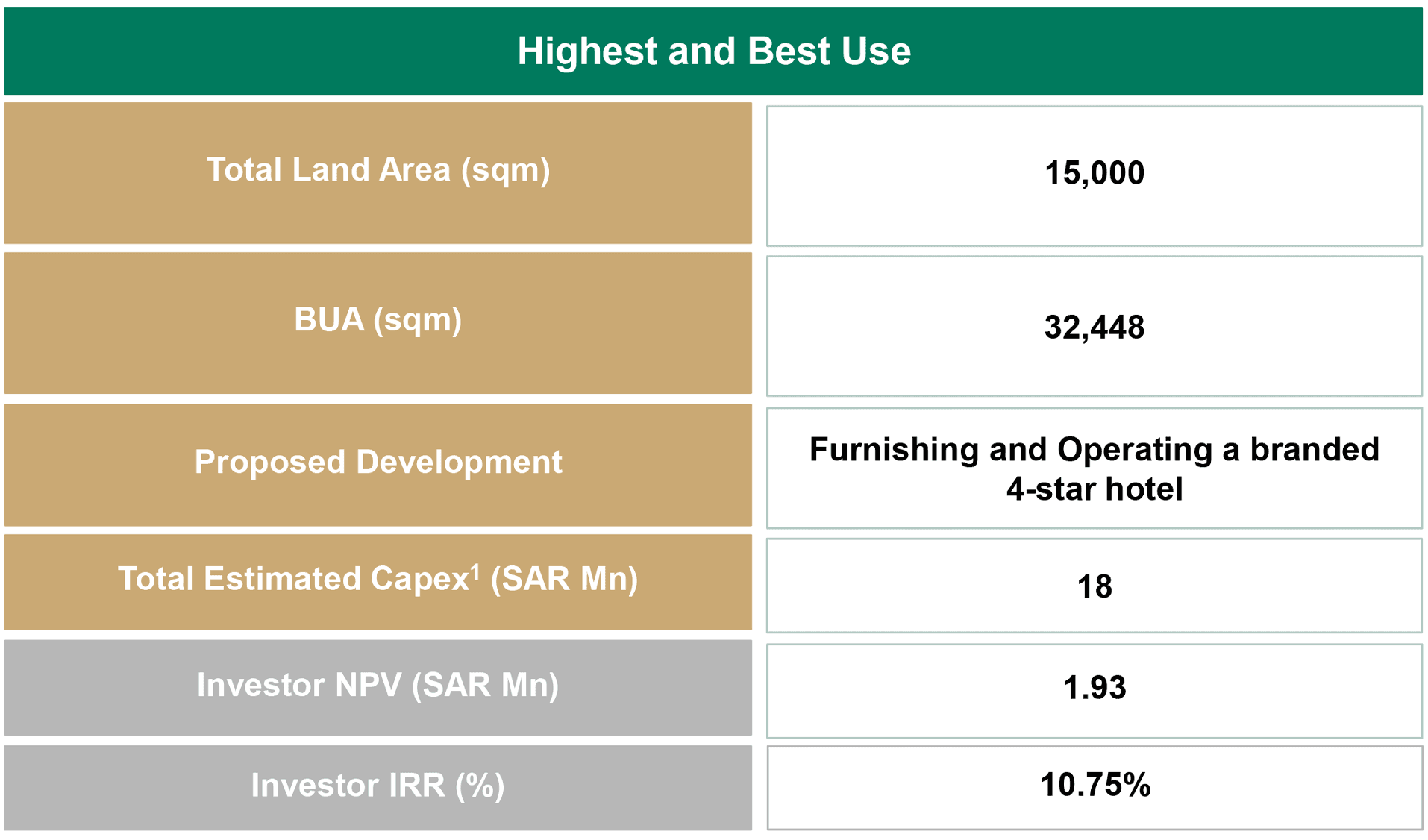

In this context, the landowner seeks to furnish and operate a branded 4-star hotel in Al Jawhara Tower in Hail, covering an area of 10,000 sqm

4-star Hotel in Al Jawhara Tower Opportunity

- “The land parcel in the second phase is located within the eastern part of the Authority’s land on Al Uqda Road and within the first phase (Al Jawhara Tower) of the allocated plot, covering an area of approximately 15,000 square meters.”

- “The site is situated on a main road in Hail city, making it suitable for a hotel project.”

- “The proposed hotel on this plot is expected to meet the city’s need for hospitality components with branded standards.”

To undertake this mission, the landowner can opt to partner with potential investors, which are currently operating within the real estate and hospitality sector in KSA.

Indicative Listing of Potential Investors Operating in Real Estate and Hospitality Sectors of KSA.

Moreover, prospective investors can leverage a set of existing incentives, currently offered in KSA, along with proposed incentives that can be provided during fit-out and operational phases of Al Jawhara Tower.

EXISTING INCENTIVES

- Waiving Municipal Licensing Fees: For hotels, hotel apartments, and residential resorts.

- Providing Guarantees to Banks: Through government entities to assist in financing hotel fit-out processes, such as the Kafalah Program by Monsha’at.

- Providing Financial Support: To fund capital costs for projects with a completion rate not exceeding 70% through the Investment Enablers Program in the hospitality sector, offered by the Ministry of Tourism.

- The Tourism Aoun Program: Offered by the Tourism Development Fund, aims to support and empower existing tourism establishments.

PROPOSED INCENTIVES

- Granting tax breaks by the relevant government authorities.

- Providing discounts on government fees.

- Granting longer rent-free periods during the lease term.

- Conducting free training programs through the Ministry of Human Resources to enhance service quality among national staff in the hospitality sector.